Home // Our Advocacy

Our Advocacy

We have been the voice of business in Grande Prairie & District for more than a hundred years!

2023 National Policy Resolution

The Grande Prairie & District Chamber of Commerce submitted the following policy resolution to the Canadian Chamber of Commerce:

"Flexible Solutions to Address the Gap in Immigration Biometric Services"

The Issue

Strong rural economies mean a stronger Canada. Immigration plays a crucial role in growing Canada’s economy and is especially vital for rural communities to grow populations and fill labour shortages. Yet current policy regarding immigration biometric services, a requirement of the immigration process, places undue hardship on applicants in some rural or northern areas in Canada, requiring them to travel long distances and bear the associated travel costs to access this service. Such policy is neither aligned with the federal government’s commitment to address systemic inequities in core institutions and policy development nor its concerted efforts to remove barriers to newcomer attraction and retention in rural Canada.

Our Recommendation

That the Government of Canada:

1. Amend Immigration, Refugees and Citizenship Canada (IRCC) policy to expand the list of eligible providers of immigration biometric services for applicants within Canada, taking into consideration those organizations outside the public sector that are fully accredited organizations through the RCMP's Canadian Criminal Real Time identification Services (CCRTIS), to fill this gap in service across Canada.

This submission was debated and voted on by Chambers from across the country during the Canadian Chamber of Commerce 2023 AGM & Convention: Energizing Canada's Future on October 13-14 in Calgary and we are pleased to announce that it was passed nearly unanimously with 98.58% approval.

Sponsor: Grande Prairie & District Chamber of Commerce

Flexible Solutions to Address the Gap in Immigration Biometric Services

Issue

Strong rural economies mean a stronger Canada. Immigration plays a crucial role in growing Canada’s economy and is especially vital for rural communities to grow populations and fill labour shortages. Yet current policy regarding immigration biometric services, a requirement of the immigration process, places undue hardship on applicants in some rural or northern areas in Canada, requiring them to travel long distances and bear the associated travel costs to access this service. Such policy is neither aligned with the federal government’s commitment to address systemic inequities in core institutions and policy development [i] nor its concerted efforts to remove barriers to newcomer attraction and retention in rural Canada.

Background

Many applicants for immigration to Canada, or for a work permit, study permit or visitor status (including extensions), are required by Immigration, Refugees and Citizenship Canada (IRCC) to provide biometrics. Data collected includes electronic fingerprints, digital photograph and biographical data (note: this is not a criminal record check). As of June 14, 2023, updated IRCC policy now requires that anyone applying for permanent residence (PR) must submit biometrics, regardless of if they have previously submitted them (during the pandemic, PR applicants did not have resubmit biometrics if they had submitted biometrics with a temporary resident application within the past decade).

As per IRCC policy, applicants who are applying from within Canada must attend their pre-booked appointment in-person at a designated Service Canada location. The issue is that not all Service Canada offices are authorized to offer immigration biometrics to in-Canada applicants, and those offices not providing this service are predominantly in rural and/or northern Canada. Further compounding the issue is that current IRCC policy does not allow biometric services for in-Canada immigration applicants to be provided outside of Service Canada.[ii]

As a result, some applicants are required to travel, in some cases great distances over multiple days, to access immigration biometric services. They (or an employer willing to absorb the cost) must expend additional funds for travel costs such as hotels, food, gas and time off work. Limited access to public transportation in many rural communities restricts travel options.

Existing literature cites a number of barriers experienced by newcomers in rural areas, including difficulty accessing settlement services due to lack of services, as well as lack of transportation.[iii] These barriers contribute to the economic and social marginalization of newcomers. They also create challenges for the many rural communities and businesses relying on immigration for unmet labour needs, population growth and long-term resilience.

According to the 2022 IRCC annual report, immigration accounts for as much as 90% of labour force growth in Canada and approximately 75% of population growth.[iv] As the large majority of immigrants to Canada settle in urban areas, the Government of Canada is offering several economic initiatives to attract talent to small and medium sized communities and rural areas to help local businesses fill labour shortages. However, Action Canada research found that while these programs have shown success in attracting growing numbers of immigrants, newcomer retention in these communities remains a challenge due to the unique barriers to immigration settlement in rural communities.[v]

The following are two examples of regions in Canada without biometric services for immigration. As key contributors to their provincial and national economies, both regions are actively targeting global markets to grow their workforce:

1) The Grande Prairie region, including the City of Grande Prairie (pop. 70,000), with its abundance of natural resources and growing economy, is actively recruiting an international workforce to fill labour shortages. The City’s Service Canada, however, does not offer immigration biometric services; applicants must make an approximately 1000 km, two-day round trip to Service Canada in Edmonton to access this service, which currently costs $85 per individual. 2) In northern British Columbia, the busiest area of the province due to major construction projects, a global workforce is critical to help fill acute labour shortages. Yet in the City of Fort St. John, for example, to give immigration biometrics, applicants must make a nearly 900 km round trip to Service Canada in Prince George.

The Ministry (IRCC) states “factors involved in selecting biometric service sites include the physical capacity of a given Service Canada location to take on a new service line; the volume of IRCC clients in a geographic area; driving distances between Service Canada locations offering biometric enrolment; and, distances that IRCC clients need to travel to get to the Service Canada location offering biometric enrolments closest to them.” Further, with respect to one of the above examples, the Ministry states that the Edmonton [Service Canada] office was chosen to serve the Grande Prairie region to “minimize the distance to the nearest location for clients.” The excessive travel requirements for the growing number of clients requiring this service do not align with the rationale provided by IRCC regarding how they chose their immigration biometric sites.

Realizing new opportunities in the private sector

As the Government of Canada seeks “to further adapt and develop more agile and effective ways to service Canadians,”[vi] Canada’s private sector offers an opportunity to help fill this gap in biometric services without creating an extra burden for taxpayers. Within the private sector, companies that are accredited through the RCMP's Canadian Criminal Real Time identification Services (CCRTIS) are providing biometric services for civil purposes. (Note: There are no private fingerprinting companies accredited by the RCMP outside of Canada.)

The CCRTIS Program assesses the security and administrative operations of companies that intend to take fingerprints for non criminal purposes. Upon completion of the accreditation process, companies are certified to operate as an affiliate of The Canadian Corps of Commissionaires and authorized to submit electronic fingerprint transactions (non criminal purposes) to CCRTIS via The Canadian Corps of Commissionaires' server. The accreditation process is robust and periodic audits are in place to ensure the integrity of the Program. A company’s accreditation, however, does not authorize it to provide immigration biometrics.

Flexible, innovative, affordable and inclusive solutions

The June 2019 House of Commons report on improving settlement services across Canada, by the Standing Committee on Citizenship and Immigration, highlights the need to remove barriers to settlement services and programs in rural communities across Canada. [vii] The report cites the requirement for flexible and innovative solutions to help attract and retain immigrants in rural communities.

Amending and adapting immigration biometrics policy with consideration to the unique immigration challenges facing rural and more remote communities and to the opportunity that currently exists within the private sector to address service gaps, promotes more equitable and accessible services for all, regardless of location. As Canada’s population ages and birthrates decline, innovative, inclusive and affordable policy solutions supporting the long term integration and retention needs of immigrants in rural and northern communities are critical to helping businesses meet labour needs and ensuring a more productive and resilient economy for Canada.

Recommendation:

That the Government of Canada:

Amend Immigration, Refugees and Citizenship Canada (IRCC) policy to expand the list of eligible providers of immigration biometric services for applicants within Canada, taking into consideration those organizations outside the public sector that are fully accredited organizations through the RCMP's Canadian Criminal Real Time identification Services (CCRTIS), to fill this gap in service across Canada.

[ii] A few exemptions apply. https://www.cic.gc.ca/english/information/where-to-give-biometrics.asp

[iii] https://www.ourcommons.ca/Content/Committee/421/CIMM/Reports/RP10577155/cimmrp26/cimmrp26-e.pdf

[iv] https://www.canada.ca/en/immigration-refugees-citizenship/corporate/publications-manuals/annual-report-parliament-immigration-2022.html#highlights

[v] https://actioncanada.ca/wp-content/uploads/2022/03/Settling-Unsettled-ENG-FINAL-WEB.pdf

Email, June 15, 2023 from S. Charbonneau, IRCC Ministerial Enquiries Division to A. Reimer

[vi] https://pm.gc.ca/en/mandate-letters/2021/12/16/minister-veterans-affairs-and-associate-minister-national-defence?fbclid=IwAR2I1LOAXtRCqOGxOOenZZ9olJJghFVrFC3E5gAUTq1pYKzNhSxDYA55j3Y

[vii] https://www.ourcommons.ca/Content/Committee/421/CIMM/Reports/RP10577155/cimmrp26/cimmrp26-e.pdf

2023 Provincial Policy Resolutions

Our Chamber sponsored or co-sponsored the following policy resolutions which were approved by the Alberta Chambers of Commerce (ACC) network at the 2023 ACC Annual General Meeting and Policy Session in Fort McMurray.

Policies are shared with government officials for follow up and discussion with the goal of eventual implementation based on the recommendations of our network. Policy development is based on feedback from our member businesses.

Investment Attraction for Industrial Zones

Issue

In order for Alberta to compete on the global stage, we need to address issues such as regulatory uncertainty and cost competitiveness so that industry has the tools it needs to maintain a competitive advantage and so that the province and regions can attract new investment opportunities.

Background

The concept of cluster development was introduced in Michael E. Porter’s paper, The Competitive Advantage of Nations published in the Harvard Business Review in the March-April 1990 edition.130 This paper references a study that aimed to determine the differentiating factors in what makes a country successfully competitive on the global scale. It consisted of a detailed, four-year analysis of 10 different countries with different cultures, strategies, and success in various industries. The paper discusses four Determinants of National Competitive Advantage: Firm Strategy, Structure, and Rivalry; Demand Conditions; Factor conditions; and Related and Supporting Industries (p.77). The last determinant references, in essence, cluster development.

Since the time of Porter’s paper, there have been numerous other studies and papers written on the subject. Ultimately, there has been a general consensus on the definition of cluster development as:

“...clusters are widely acknowledged as a type of activity-specific system, situated within broader regional innovation systems, where interaction between actors supports quicker diffusion and absorption of knowledge, more effective innovation and efficient solutions to a range of other localized drivers of competitiveness”. (Wilson et al., 2022).131

This discussion has spurred many local and regionalized innovation hubs and is the underlying basis of the Designated Industrial Zone (DIZ) concept. If there are related businesses located in close proximity to one another with the benefits of regulatory streamlining, there is an increased likelihood of those businesses experiencing a successful outcome.

In 2022, the Alberta Government announced that it would move forward with a Designated Industrial Zone pilot in Alberta’s Industrial Heartland. This project was contingent on six critical factors: formal agreement, coordinated zoning, target size and scale, cluster infrastructure, harmonized permitting, and environmental management. The Industrial Heartland is located in Central Alberta, spread across five municipalities covering a total area of 592km2, and is primarily focused on the petrochemical industry.

Given that Alberta’s Industrial Heartland is the first government partnership of its kind, it can be referred to as a model for future zones. The petrochemical industry was an obvious starting place for the province’s first DIZ as the region had already been identified as a priority for the province132 and industrial development in the region was already taking place. The petrochemical sector accounts for approximately one-third of Alberta's total manufacturing exports, producing 27% of Canada’s chemical output. Contributing $6.8 Billion to the provincial GDP and $6 Billion in exports, Alberta has modern, world-scale plants with access to abundant resource feedstock and efficient transportation systems. There is significant potential for investors who are interested in taking advantage of Alberta’s vast energy resources and new government development programs to build new petrochemical plants in the province.

In addition, industrial manufacturing is a foundational industry that supports infrastructure development as well as energy and natural resource production in Alberta. With world-class expertise and access to global supply chains, Alberta’s industrial manufacturing sector delivers high-value products and services across Canada and around the world. Alberta’s industrial manufacturing industry has key strengths that make the industry competitive and positioned for growth with $2.6 Billion in GDP and $1.3 B in exports, there is opportunity to expand this sector.133

There are environmental considerations that must be noted with such a large area focused on the development of these two important industries. The provincial government has committed to responsible energy development and a sensible approach to environmental protection. In an effort to achieve balance, the Alberta government is actively updating its environmental strategy to address topsoil management guidelines, air emissions requirements, water quality management, environmental assessments, and financial or human resources for implementing environmental management programs134 within the DIZ.

In terms of economic development for the region and the province, EY completed an Economic Impact Study on Alberta’s Industrial Heartland, released in July of 2019135. In terms of the provincial direct, indirect, and induced economic impacts, the combined operational expenditures in the region resulted in $4.476 billion in output, meaning the “total economic activity of new goods and services because of activities occurring within a particular area”. Furthermore, there was more than $1.756 billion in GDP, $1.594 billion in wages, and the equivalent of 23,213 FTEs (p.35) in one year. The capital expenditures over the period of 2017-2020 resulted in $17.243 in output, $10.500 in GDP, and 7,935 FTEs resulting in $1.581 in wages. With a provincial and regional collaboration, there is an expectation that the additional resources put toward streamlining regulation and shared infrastructure while mitigating environmental impacts will contribute to an increase in the measurable economic impact for the region and the province.

While Alberta’s Industrial Heartland is primarily comprised of petrochemical operations, there should be a focus on developing DIZs supporting the development of other industries across the province. The streamlining of provincial regulations is a critical piece to the success of a DIZ and the organizations located within it, and therefore any provincial policy should reflect the niche organizations within the specific DIZ. As referenced by Porter (1998) “The aim of cluster policy is to reinforce the development of all clusters.” "Governments should not choose among clusters, because each one offers opportunities to improve productivity and support rising wages.”136

Given both the studied success of cluster developments in addition to the demonstrated benefit within the Province of Alberta, it is apparent that there is an advantage to cluster development with streamlined regulations within a designated region. Therefore, it should be a goal of the government to facilitate the development of additional designated industrial zones in the province.

The Alberta Chambers of Commerce recommends the Government of Alberta:

- Work with municipalities to clarify the process of obtaining an industrial zone designation in support of expanding the number of industrial zones across our province;

- Assist and facilitate qualifying municipalities to better understand the requirements associated with streamlining regulatory approvals;

- Create a "concierge service" for large industrial projects to remove barriers and guide them through the permitting and regulatory processes while requiring high standards for safety and environmental performance;

- Provide investment attraction support programs with fair and equitable opportunity to any company that meets the eligibility criteria in alignment with existing economic development partners.

130 Porter, M. E. (1990). The competitive advantage of nations. Harvard Business Review. https://hbr.org/1990/03/thecompetitive-advantage-of-nations

131 Wilson, J., Wise, E. & Smith, M. (2022). Evidencing the benefits of cluster policies: towards a generalized framework of effects. Policy Sciences, 55, 369-391. https://doi.org/10.1007/s11077-022-09460-8

132 https://investalberta.ca/industry-profiles/petrochemicals/

133 https://investalberta.ca/industry-profiles/industrial-manufacturing/

134 https://www.alberta.ca/industrial-heartland-designated-industrial-zone.aspx

135 https://industrialheartland.com/wp-content/uploads/2019/07/EYLLP_AIH_EconomicImpactStudy.pdf

136 Porter, M. E. (1998). Clusters and the new economics of competition. Harvard Business Review. https://hbr.org/1998/11/clusters- and-the-new-economics-of-competition

Progressive Regulations to Promote Clean Technology and District Energy

The Issue

Alberta regulations are lagging in making renewable energy and clean technology feasible for consumers. Specifically, the Province’s micro-generation regulations restrict Alberta businesses from aggregating sites owned by customers, in turn restricting their ability to generate and distribute any excess energy directly to other buildings or compound residence (district energy). Adapting provincial regulations to promote self-generation with clean technology and district energy sources is an important climate change strategy for Alberta, and an opportunity to reduce costs and improve competitiveness for Alberta businesses.

Background

Rising demand for electricity in Alberta

Locally and globally, there is an increasing need for electricity, due to a growing demand for air conditioning, electric heating, and electrified transportation, for example. Growing electricity demand will result in higher delivery and electricity prices: upgrades to infrastructure and construction of generation will be necessary, resulting in costs being passed on to consumers.

In Canada, communities account for 60 percent of total energy consumption and half of Canada’s emissions – making them key players in our country’s goal to reduce emissions. And while carbon based fuels will likely remain an important part of our energy system for decades, Alberta has an opportunity to better utilize our fossil fuels by improving the way we use our existing energy sources while transitioning to low and zero emission solutions that are available right now, such as district energy systems.

What is district energy (DE)

District energy systems (DES) use a central energy plant to provide efficient heating, cooling, hot water and power to a group of buildings. Modern systems (climate-resilient and low-carbon) are one of the least-cost and most efficient solutions in reducing emissions and primary energy demand.148 These systems use alternative energy sources, such as wood waste, sewer heat or waste heat, captured from other processes. Typically, DE is almost fully consumed by consumers within that compound, building or subdivision; excess electricity is sold to the grid.

Benefits

DES have a number of benefits that support communities and business:

More cost effective.

Serving many customers from one location, DES have lower operations and maintenance costs than buildings with in-building heating systems. Buildings connected to DES have lower capital costs and smaller footprints and, as such, fewer associated costs (insurance, maintenance, upgrade, etc.).

Reduced carbon footprint.

DES use alternative energy sources and have greater efficiency, producing fewer greenhouse gas emissions than fossil fuel-based systems.

Viable, reliable and readily available technology.

DES are proven technologies, and are already in place in other parts of Canada and around the world.149

Reliable access to energy.

Increasingly faced with electricity brownouts or blackouts from ice, snow and wind storms, floods and fires, low carbon technologies like DES can add to Albertans’ energy security.150

Fundamental to more resilient communities.

Quest Canada, a national non-profit actively working to accelerate the adoption of efficient and integrated community-scale energy systems in Canada, promotes the value of DE technology in building more resilient communities, citing its environmental, economic and reliability benefits. 151

Barriers in Alberta

Current Alberta regulations do not allow a property owner to install generation and sell electricity to the occupants of buildings, compounds or subdivisions. The energy must be sold to the grid through electric distribution system-connected generation (DCG), and then bought back to customers at market rates. Further, while building owners have the option of installing micro- generation, they cannot produce more than what they can consume through their own metering points.

Alberta regulations for small, medium and large business have misaligned incentives for self- generation options. 1). Bulk metering for landlords of commercial retail units and office towers, apartments or large condominium residence is not allowed; 2). There is no incentive for developers of these facilities to install, partner or adapt district energy sources; 3). Micro- generation regulations are restrictive on aggregating sites owned by customers and the distribution of energy is limited at this time; and, 4). Utilities will not allow for building owners to manage the costs of energy for their facilities as rates do not allow such a transaction.

As early as 2017, the Alberta Electric Distribution System-Connected Generation Inquiry identified the need for regulatory change to accommodate growth in the district energy sector in Alberta.152 However, current regulations in the province continue to hamper DES, despite their proven benefits and viability. Furthermore, incentive programs available through Emissions Reduction Alberta, the Municipal Climate Change Action Centre, and other sources do not support funding programs that could benefit DES’ implementations.

As part of its climate change plan, the Government of Alberta has set a target of 30 percent of electrical energy produced in Alberta to be generated from renewable sources by 2030. Progressive policies and strategies in Alberta that promote self-generation with clean technology, such as DES, support an affordable, flexible, reliable and environmentally responsible alternative to energy delivery for Alberta consumers. Such an approach creates an environment of resiliency and competitiveness for Alberta businesses and communities.

The Alberta Chambers of Commerce Recommends that the Government of Alberta:

- Implement an industrial, commercial and residential regulatory framework that allows customers to install district energy systems for the sharing of electricity and heat between tenants and neighboring buildings. Such a framework would include checks and balances to ensure cost controls are in place to protect end use customers.

- Include, support and promote district energy systems in programs and policies aimed at helping drive Alberta and Canada’s climate change aspirations, more resilient communities and a more competitive economy.

148 https://www.districtenergy.org/topics/district-energy-cities

149 http://www.auc.ab.ca/regulatory_documents/Consultations/DistributionGenerationReport.pdf

150 https://www.bing.com/videos/search?q=youtube+atco+microgen- renewables&view=detail&mid=8200969BCACD8C2BCEE18200969BCACD8C2BCEE1&FORM=VIRE

151 https://questcanada.org/

152 http://www.auc.ab.ca/regulatory_documents/Consultations/DistributionGenerationReport.pdf

Efficiencies at the Alberta Land Titles Office

Issue

The Alberta Land Titles Office is currently delayed four months in processing documents submitted for registration. The delay affects individuals buying and selling properties; lenders registering a mortgage; creditors enforcing civil claims judgments; individuals applying for building and development permits; municipal tax departments issuing tax notices; and industries involved in finalizing real estate transactions. This is an urgent issue, and it must be resolved as soon as possible.

Background

As of January 21, 2023, the current delay at the Alberta Land Titles Office for processing registrations is over 4 months.396 The delay in processing documents has been an issue for stakeholders since 2021.

The processing delay has had a negative impact for all home buyers. The current delay in processing registrations means that buyers of recently purchased properties do not receive a certificate of title confirming ownership for over 4 months after closing of the transaction. In addition, new homeowners are experiencing delays in applying for building and development permits as a direct result of the processing delay at the Alberta Land Titles Office.

The delay has had negative effects on both municipalities as well as homeowners. Property Tax Assessments are not being sent out in a timely manner and are often sent to the previous owner of a property which was recently sold.

The delay has also had a negative impact on business. Law firms must wait until registration has been completed prior to finalizing their report and account. This has caused cash flow issues for some as a result. In addition, certain lenders have pulled out of real estate transactions because of the long delay.

Other jurisdictions in Canada have a streamlined process which enables registration to occur in a timely manner. Saskatchewan and British Columbia currently register documents submitted in less than two weeks.

Whilst we applaud Service Alberta for its attempts to rectify this issue over the past 18 months, more needs to be done, as the unacceptable delays in processing registrations still exist.

We recommend the Alberta Government commit to rectifying the current delays at the Alberta Land Titles Office. Efficiency is particularly important to business and individuals, and it is imperative that the Alberta Land Titles Office return to timely processing speeds.

The Alberta Chambers of Commerce recommends that the Government of Alberta work with industry and stakeholders to address the lengthy processing delays by:

1. Increasing staffing to adequately deal with current processing volumes;

2. Develop an action plan to quickly and effectively remove current system delays and modernize the Alberta land titles system, creating a reliable, responsive, timely, secure and sustainable system able to meet market demands into the future, including:

- Legislation and investment that supports modern technology and best practices;

- An innovative and digitized platform that facilitates online business transactions, potentially applying solutions which have been successfully implemented in other Provinces;

- Streamlined operations and overall business practices to ensure documents submitted to the Alberta Land Titles Office are processed efficiently and effectively, with a goal that documents will be processed no later than 30 days after submission.

396 SpinIIHost (gov.ab.ca)

Dec 04, 2023

Land Titles backlog eliminated

Alberta’s government has eliminated the backlog in the Land Titles office, and for the first time in more than two years, processing times are back to normal.

Between April 2021 and December 2022, requests at Alberta’s Land Titles office increased by 86 per cent. This increase was a response to Alberta’s growing population and economy, and wait times were exacerbated through the COVID-19 pandemic.

To tackle the delays, the government increased funding and staffing to the office, and kept counter service closed past the pandemic to address the backlog. Now that processing times have been reduced, Albertans doing real estate transactions, and the professionals supporting them, can focus on investment and economic growth.

“The successful elimination of a two-year backlog in land titles brings renewed economic growth and prosperity to the province. Land titles are vital for sectors like real estate, agriculture and resource development, as they ensure legal ownership and facilitate transactions. Through collaboration with employees and industry stakeholders, the land title registration process has been streamlined, resulting in a significant boost to the Alberta economy.”

- Dale Nally, Minister of Service Alberta and Red Tape Reduction

Every day, more than $340 million in economic activity is processed through Alberta’s Land Titles office, so addressing this backlog was crucial. Processing times peaked in December 2022, when Albertans were experiencing 84 days to process a transfer and register a title and 55 business days for surveys. Now, those processing times are down to 10 to 12 days, the lowest in more than two years. With processing times back to normal, full front counter service has reopened to the public.

“We want to commend Minister Nally and staff at the Land Titles office for the incredible progress made on addressing delays in land titles. By eliminating the backlog in the short term while committing to a modernized system in the long term, the Government of Alberta is supporting a reduction in red tape, costs and the unnecessary delays that have prevented Albertans from getting into homes.”

- Scott Fash, chief executive officer, Building Industry and Land Development Association Alberta

“This announcement will help to vastly improve wait times for all and ultimately allow legal professionals to ensure their clients are being serviced in a timely and professional manner. This is a huge step forward and the AAPP is looking forward to working with government on continued process improvements in other areas that impact Albertans.”

- Heidi Semkowich, president, Alberta Association of Professional Paralegals

Alberta’s government is investing nearly $60 million over three years to replace Land Titles’ outdated systems and improve service delivery. Currently, many of these systems are paper-based and ill-equipped to respond to changing market conditions. When this work is complete, it is expected documents will be processed within five business days.

Quick facts

- More than $50 billion in real estate transactions are conducted in Alberta every year.

- More than $500 billion in private property is managed through the Land Titles registry.

- The Land Titles office has two locations: one in Edmonton and one in Calgary.

- To ensure statutory compliance and property rights of owners, the Land Titles office conducts careful and thorough reviews of all documents and plans that are submitted.

- All changes to title (i.e., who owns the land) must be registered with the Land Titles office.

Related information

Land titles

Modernization of Alberta Registry Agents

Issue

The Government of Alberta regulates the Alberta Registry Agents’ (ARAs) Regulation by capping the fee amounts for most of the services they provide. In addition, Registry Agents are eager to develop a modernization plan to enhance services, including online registry services to Albertans in conjunction with Service Alberta and other stakeholders. The Government of Alberta should support these modernization efforts and review regulations to ensure Alberta Registry Agents can continue their vital work effectively.

Background

Alberta’s Authorized Registry Agents form a network that collectively employs over 1,500 Albertans. There are 217 Agents located in 150 Alberta communities (58 or 27% are in Calgary and Edmonton, 48 or 22% are in small municipalities, and 111 or 51% are in rural municipalities). Registries are a vital part of Albertan communities in providing economic growth, stable jobs, important community links, and essential services.

Albertans value registry services and continue to take advantage of the ease of access offered by local registry agents. In survey findings, 74% of respondents have visited a registry agent in the last year. Furthermore, over 90% of respondents expressed the importance of having access to registry services located in their communities and felt that it would have a negative impact on their communities if their local Registry Agent were to close.397

As registry services modernize to meet the needs of our society, Albertans must continue to have equal access to quality in-person registry services, regardless of where they live in the province. A healthy industry ensures ongoing service to Albertans throughout the province at an affordable price. Eight registry offices have closed in the last two and a half years and many more communities are at risk of losing their local registry. An independent third-party audit found that registry agents who have an annual volume of 10,000 transactions or less are operating at a loss, which represents sixty- four registries.

Unlike other similar provincially regulated industries, there is no regular mechanism to review government capped registry service fees. In order for the registry agent network to position itself to serve the diverse needs of all Albertans, it is essential for a fee review model be put in place that includes regular and predictable reviews of capped service charges that provides financial stability and long-term assurance of sustainability. Between 2005 and 2020, registry agents received no increases to capped service fees despite increased cost pressures. A static capped fee restricts registry agents from keeping pace with natural operational increases and limits the amount of capital that can be reinvested into businesses in order to expand and modernize their delivery models in a variety of settings.

A combination of rural, urban, online, and in-person delivery models offered by Registry Agents are needed to provide Albertans services for over 200 products on behalf of five government departments. In order to ensure that registry agents are equipped and can work effectively and efficiently, having the support of the government is crucial. A modern and viable business model needs to be developed to guarantee the levels of service and access is not only maintained but also expanded to reflect the dynamic nature of the industry. Additionally, the Government of Alberta is still in direct competition with Registry Agents for some online services, like traffic fines.

Other organizations also see the value in a new fee review model and the modernization of the industry to ensure the continuance of the high level of service which Albertans have come to expect from their Registry Agents. In 2016, the Alberta Urban Municipalities Association (AUMA) passed a resolution recognizing the “vital role and positive impact that ARAs have in Alberta communities” and recommended the Government of Alberta negotiate a new fee structure and protect ARAs revenue streams.398

The Government of Alberta responded on January 1, 2020399 by increasing capped fees only on certain services for the first time in 14 years. However, these changes alone without a long-term sustainability plan do not ensure both a sustainable business model and expansion of services for Registry agents, nor do they provide the support necessary to aid in the modernization of the Registry Agent Industry. The Government of Alberta should recognize the vital role of Registry Agents in the delivery of essential government services to all Albertans, particularly their positive impact in rural Alberta communities, and work to strengthen their partnership with the Association of Alberta Registry Agents and local municipalities.

The Alberta Chambers of Commerce recommends the Government of Alberta:

- Support further modernization of the Registry Agent Industry and red tape reduction.

- Continue to partner with Registry Agents to provide online services and allow registry services to expand online offering; and

- Ensure the long-term sustainability of Registry Agents, including those serving rural communities, with a fair and equitable service charge model.

397 Couillard, C. (2019, April 16). Opinion: Registry-agent services under threat by rising costs. Edmonton Journal. https://edmontonjournal.com/opinion/columnists/opinion-registry-agent-services-under-threat-by-rising-costs

398 Alberta Municipalities (2016). Sustainable Support for Local Registry Agents. https://www.abmunis.ca/resolution/sustainable-support-local-registry-agents

399 Government of Alberta. (2019). Fiscal Plan: A plan for jobs and the economy 2019-23. https://open.alberta.ca/dataset/3d732c88-68b0-4328-9e52-5d3273527204/resource/2b82a075-f8c2-4586- a2d83ce8528a24e1/download/budget-2019-fiscal-plan-2019-23.pdf

Streamline Size of Government

Issue

While government spending is needed to ensure the health and safety of its constituents, there are studies that have shown that when government grows beyond a certain size it can hinder economic growth and lead to an overall lowering of living standards.

Background

There are a variety of methods by which the size of a government can be measured. One method is based on per capita spending, and another is to consider government spending as a percentage of GDP. Both methods can also factor in measures for tax expenditures and regulation1. Following the inevitable major increase in fiscal year 2020 as a result of the COVID- 19 pandemic, there has not been a decrease in the size of our federal or provincial governments back to pre-pandemic levels234.

The spending as a percentage of GDP of our federal government is among the highest it’s ever been5. A study released by the Fraser Institute in 2013 found that the optimal level for government spending as a percentage of GDP is 26%, after which the economic and societal benefits decline for each additional dollar spent6. Since 1870, the Canadian government has had expenditures as a percentage of GDP over 26% for 65 years. During World War II for the years of 1942-1945 government spending averaged 44.62% which is typical for wartime expenditures. This was followed by a 15-year period during which expenditures ranged from 14.03% to 22.16% with an average of 15.77%. Since 1961, the government has not had a single year with expenditures below 29% (lowest was 29.66% in 1964) and has even spent as much as 53.34% in 1992. This has resulted in an average yearly expenditure of 41.31% for the years between 1961 and 2021. Furthermore, the percentage spent has been trending upward for this same period.

On a provincial level, the data demonstrates a similar trend. There have been consistent increases in spending per capita since 2007, with increases ranging from just 0.65% in 2013 to 9.76% in 200778 with an average increase of 2.76% between 2007 and 2021. A report released by the Financial Accountability Office of Ontario in April of 2022 shows that, comparatively, Alberta has the lowest per capita revenue in 2020, yet was consistently above the average in regard to program spending9.

The consistent growth in government expenditures per capita and relative to GDP, if left unchecked, can result in deficit budgets, and increases in debt and associated debt repayment costs. The Parliamentary Budget Officer released its Economic and Fiscal Outlook in October of 2022 projecting a year-over-year decrease in budget deficit, but a significant increase in debt servicing charges. In fact, there is an anticipated doubling of public debt charges from their 2020-2021 levels to $47.6 billion in 2027-202810. Despite being debt free in the early 2000’s, the Alberta government has run deficits since 2008-2009 which has resulted in steadily increasing debt11. Furthermore, the associated debt servicing costs are expected to continue increasing beyond $2.7 billion in fiscal year 2022-202312.

While the growth of the size of government and associated debt can at times seem inevitable, there is a solution in Canada’s not-so-recent past. Canada has successfully navigated out of a position where the growth of the economy was seriously impeded and Canadian’s prosperity was at risk as a result of the size of government and its related spending. Steps to put Canada back on a road of fiscal sovereignty were taken by successive governments starting in the mid 80’s and culminating in the Government of Canada initiating a Program Review in 1994. This program review, implemented over five years, rejected the concept of across-the-board cuts and the idea that a sizable deficit could be eliminated through increased productivity. Instead, it focused on the roles and importance of government programs and services within the overall fiscal framework. The program review was not about “what to cut” but instead used methods of fiscal constraint while considering “what to preserve” to put the country on a footing that would allow it to prosper in the future.

The foundation for this review used a series of six questions when looking at the services and programs administered by the government.

1. Does the program or activity continue to serve the public interest?

2. Is there a legitimate and necessary role for government in this program area or activity?

3. Is the current role of the government appropriate or is the program a candidate for realignment with the provinces?

4. What activities or programs should, or could, be transferred in whole or in part to the private or voluntary sector?

5. If the program or activity continues, how could its efficiency be improved?

6. Is the resultant package of programs and activities affordable within the fiscal restraint? If not, what programs or activities should be abandoned?

The result of this ongoing process looped back on itself if the overall proposal did not generate significant savings13. In addition, this process ensured that the federal government used only the resources it needed to deliver services strictly within the government's purview. As a result of this program review, Canada's total government spending as a share of GDP fell from a peak of 53 percent in 1992 to 39 percent in 2007, and despite this more than one-quarter decline in the size of government, the economy grew, the job market expanded, and poverty rates fell dramatically14.

The rationale behind having a government that is scaled properly to deliver essential services is not just one borne from a budgetary standpoint. When a government functions efficiently and uses its resources to their maximum potential it could be argued that it is on a much better footing when the economy or market forces pose challenges. Ensuring that government has the ability to adapt, maneuver, and respond to weather economic headwinds is dependent on how its resources are allocated.

This is not to be confused with across-the-board cuts and freezes that affect programs and services or by strictly asking departments and agencies to do more with less. What is needed is a repositioning of the role of government within the collective means of citizens using the criteria above. An essential component of this course of action would be a comprehensive review of the regulatory environment, using the recommendations set forth by the Canadian Chamber of Commerce in the Regulate Smarter report, Death by 130,000 Cuts: Improving Canada’s Regulatory Competitiveness15. The recommendations laid out in this report mirror the reasoning behind a comprehensive full program review. By modernizing Canada’s regulatory systems and reducing duplication and misalignment within regulations, competitiveness and a well-functioning regulatory regime will ensure a government ready and able to meet the challenges and respond to opportunities that present themselves in a more integrated global economy. This would ensure that protective measures would be balanced with a regime that is navigable and preserves economic growth and competitiveness.

However, the longer the process of streamlining government is delayed the harder it is to reset. External factors beyond the government’s control can take precedence and make needed changes that much more difficult. An immediate first step is to aim for government, both federal and provincial budgets that are balanced. This will then set a solid foundation allowing for a re-visioning of size of government. Canada and Alberta need to ensure we are set on a firm fiscal footing in order to allow for flexibility should market forces create downward economic pressure resulting in the continued need for stimulus spending. It is not only good fiscal policy but responsible governing to create a safe cushion for the province and country.

As in the past this exercise will be one that requires a long-term vision that spans government administrations and political parties. Good government is not a question of ideology, right or left, but rather a commitment to a government structure that is more accessible, navigable, competitive and streamlined so that all Canadians benefit and prosper.

The Alberta Chambers of Commerce recommends the Government of Alberta and Government of Canada

- Initiate a review of all ministries that evaluates the ministry focus and alignment, to be consistent with other provinces, territories and federal government ministries, as well as alignment with service delivery and focus areas based on private and voluntary sectors;

- Work towards consistency in government ministries to avoid regular changes to ministry titles, related costs to implement changes to ministry titles and unnecessary uncertainty associated with regular changes within the Ministry and department staffing requirements;

- Commit to comprehensive regulatory reform based on cost-benefit analysis and rooted in economic competitiveness and efficient service and program delivery.

1 Macdonald-Laurier Institute – Estimating the True Size of Government in Canada: https://www.macdonaldlaurier.ca/size-of-government-in-canada/

2 Statistics Canada. (2022). Canadian classification of functions of government, by general government component (x 1,000,000). https://doi.org/10.25318/1010002401-eng

3 World Bank. (n.d.). GDP (current US$) - Canada. https://data.worldbank.org/indicator/NY.GDP.MKTP.CD?end=2021&locations=CA&most_recent_year_ desc=true& start=1960&view=chart

4 Government of Alberta. (2022). Gross Domestic Product. In Regional Economic Dashboard. https://economicdashboard.alberta.ca/grossdomesticproduct

5 International Monetary Fund. (n.d.). Government expenditure, percent of GDP. https://www.imf.org/external/datamapper/exp@FPP/CAN

6 Di Matteo, L. (2013). Measuring Government in the Twenty-first Century: An International Overview of the Size and Efficiency of Public Spending. The Fraser Institute. https://www.fraserinstitute.org/sites/default/files/measuring-government-in-the-21st-century.pdf

7 Statistics Canada. Table 17-10-0005-01 Population estimates on July 1st, by age and sex. https://doi.org/10.25318/1710000501-eng

8 Statistics Canada. Table 36-10-0450-01 Revenue, expenditure and budgetary balance - General governments, provincial and territorial economic accounts (x 1,000,000). https://doi.org/10.25318/3610045001-eng

9 Financial Accountability Office of Ontario. (2022). 2020-21 Interprovincial Comparison: Comparing Ontario’s fiscal position with other provinces after the first year of the COVID-19 pandemic. https://www.fao- on.org/en/Blog/Publications/interprovincial-comparison-2022

10 Office of the Parliamentary Budget Officer. (2022). Economic and Fiscal Outlook – October 2022. https://distribution-a617274656661637473.pbo- dpb.ca/258865a69ecf369e99f05a9e799d04136ed8c0b04830967d0ad5aecfd59f90f9

11 Eisen, B. (2022). Alberta taxpayers on the hook (again) for government debt interest. Fraser Institute. https://www.fraserinstitute.org/article/alberta-taxpayers-on-the-hook-again-for-government-debtinterest

12 Government of Alberta. (2022). 2022-23 Mid-year Fiscal Update and Economic Statement. https://open.alberta.ca/dataset/9c81a5a7-cdf1-49ad-a923-d1ecb42944e4/resource/df205b7a-721a486b-b663- 8c1ecef46ae8/download/tbf-2022-23-mid-year-fiscal-update-and-economic-statement.pdf

13 Spear, S. & Lammam, C. (n.d.). Proper Size of Government. Fraser Institute. www.fraserinstitute.org/article/proper-size-government

14 Bourgon, J. (2009). Program Review: The Government of Canada’s experience eliminating the deficit, 1995-99: a Canadian Case Study. Institute for Government. https://www.instituteforgovernment.org.uk/sites/default/files/publications/Program%20Review.pdf

15 Canadian Chamber of Commerce. (2018). Death by 130,000 Cuts: Improving Canada’s regulatory competitiveness. https://chamber.ca/publications/death-by-130000-cuts-improving-canadasregulatory-competitiveness/

The City of Grande Prairie is proud to be a designated community under the Rural Renewal Stream of the Alberta Advantage Immigration Program.

The Rural Renewal Stream offers eligible workers the opportunity to immigrate to Alberta as a Provincial Nominee with the formal support of the municipal government.

With the support of this program, the City of Grande Prairie fills local labour gaps by endorsing employers and job seekers to fast-track immigration for eligible candidates.

The Grande Prairie Rural Renewal Stream Community Partnership is made up of community stakeholders with a shared mandate of supporting employers and newcomers to the community.

The partnership is made up of:

- The City of Grande Prairie

- The Grande Prairie and District Chamber of Commerce

- The Grande Prairie Centre for Newcomers

- The Council for Lifelong Learning

The ‘Community Partnership’ is responsible for supporting the City of Grande Prairie in identifying eligible employers and endorsing candidates who are a good fit for the community and are interested in applying for permanent residency through the Alberta Advantage Immigration Program – Rural Renewal Stream.

For more information, visit https://cityofgp.com/culture-community/about-grande-prairie/moving-grande-prairie/immigration-rural-renewal-stream

2022 National Policy Resolution

Our Chamber's policy resolution was passed with 98% approval by delegates at the 2022 Canadian Chamber of Commerce Annual General Meeting and Convention in Ottawa. The full document can be seen below.

Sponsor: Grande Prairie & District Chamber of Commerce

Reducing the Cost of Working through Reform to GIS Thresholds

Issue

Labour shortages, already a pressing issue for Canadian businesses before the COVID-19 pandemic, are growing and new ones emerging. Yet Canada’s Guaranteed Income Supplement (GIS) program clawbacks are creating barriers to labour market participation for many employable older adults by discouraging the pursuit of income exceeding set values to qualify for GIS. This is increasing labour market pressures, negatively impacting quality of life and limiting Canada’s potential economic output.

Background

Canada’s Retirement Income System (RIS),(1) which includes GIS, functions on many of the assumptions that we had decades ago. Though some reforms recently have been introduced, innovation to Canada’s RIS programs has been slow, especially in light of the evolving economic, demographic, social and labour market context. Research posits that a lack of integrated political decision-making, regulation and research is restricting RIS innovation.(2)

When Canada’s public pension programs were designed over 50 years ago, the average age of the population was under 30. We’re now on average over 40-years-old and living longer. About 23% of the working age population will be 65 years or older by 2024. Between 2021-2024, Canada will lose about

600,000 workers as people age and exceed 65-years-old, lowering the share of the population participating in labour markets.(3)

Further, many Canadians now face personal financial uncertainty.

(4) Forty years ago, almost half of working Canadians had some form of pension coverage. Today, only about one-third do. Faced with living longer and fewer savings, worries about “inadequate savings for retirement, outliving their money, and affording health services that are not universally guaranteed (such as long-term care)”(5) are more prevalent.

What is concerning is that while Canada is experiencing a declining labour force and Canadians are facing increasing costs of living and inadequate savings for retirement, research(6) shows features of Canada’s public retirement income system have significant work and income earning disincentives for older workers. The greatest impact is on recipients of Guaranteed Income Supplement (GIS), a government program intended to support low income seniors.

Basic Old Age Security (OAS) is a monthly payment available to all Canadian residents aged 65 and over. GIS is based on income and is available to low income OAS recipients. A single senior qualifies for GIS if their income is below $19,464; couples qualify if their combined income is below $46,656.

These thresholds are meant to provide “floors” to keep people out poverty. To provide greater context for GIS thresholds, in Alberta, for example, the thresholds to meet “low income status” for Alberta’s Community Housing Program are much higher: $25,500 to $43,000 (bachelor, 2021), depending on where you live.(7) This represents the minimum income required to meet basic needs in different municipalities throughout Alberta.

What is discouraging low earning seniors from saving for retirement and taking employment is that GIS benefits are reduced or clawed back for other income earned, including employment and self-employment income, above $5,000 per year. For earnings between $5,000 and $15,000, GIS will be reduced by 50 cents for every dollar of income received.(8)

Further, because GIS is based on previous year’s income, the effect of earning additional income can be experienced for up to two years. For example, if an individual receiving GIS earns other income over $5,000 in 2020, the GIS for that year is clawed back after they file their 2020 taxes and they will continue to lose the monthly benefit amount until they file their 2021 tax return showing no additional income. Although GIS is paid retroactively for qualifying years, the loss of GIS income for an entire year can have significant impact on quality of life during that time period.

In addition, other provincial income supplements, and health and basic needs programs are also restricted if the individual earns income. Although these individuals are in need of additional income to meet basic living expenses, the risk of losing benefits creates a major disincentive for earning additional income through part-time employment.

Reform of GIS clawback mechanisms to incentivize older workers to participate in the labour force aligns with recommendations from the Melbourne-Mercer Global Pension Index (MMGPI), which benchmarks and ranks retirement income systems across the world. In 2019, MMGI made three recommendations for

improvement to Canada’s RIS. One of those is: “Increase labour force participation rates at older ages as life expectancy increases.”(9)

When Canadians work longer there are numerous benefits to the economy and workplaces:(10)

- Modeling shows that the impact to Canada could be substantial in terms of extra labour supply and real output and would result in a substantial increase in living standards.

- Studies show that 1) older workers’ accumulated knowledge, leadership skills and high job match quality contribute to high productivity; and, 2) since experience is a key element in the commercialization aspects of innovation, an older workforce may increase this dimension of innovative capacity.

- More seniors working drives economic growth and generates tax revenue for government.

Recommendations

That the federal government:

1. Work with provincial and territory governments, industry and academia to create a modern framework for RIS that includes undertaking a comprehensive review of the GIS income thresholds and clawback rates to allow for higher earnings exemptions and income thresholds, which will incentivize older

Canadians to voluntarily delay receiving RIS, delay retirement or enter the labour force after retirement.

2. Ensure reform encourages and allows as much participation as possible in the workforce for GIS recipients, helps these individuals stay out of poverty, and allows them to maintain or improve their standard of living.

Notes

1 Canada’s retirement income system is federally-administered publicly funded, and contains three pillars: 1) Old Age Security (OAS) and the Guaranteed Income Supplement (GIS); 2) the Canada and Quebec Pension Plans (C/QPP); and, 3) tax-deferred and other private savings and workplace pensions.

2 https://static1.squarespace.com/static/5c2fa7b03917eed9b5a436d8/t/5e41c25873b8a7233f398b72/1581367901417/Improving-Canada-sRetirement-Income-System-Setting-Priorities_final.pdf

3 https://thoughtleadership.rbc.com/squeeze-play-higher-wages-alone-wont-solve-canadas-labour-shortage-problem/

4 https://www.cpacanada.ca/en/news/features/2021-11-04-labour-shortage

5 https://static1.squarespace.com/static/5c2fa7b03917eed9b5a436d8/t/5e41c25873b8a7233f398b72/1581367901417/Improving-Canada-sRetirement-Income-System-Setting-Priorities_final.pdf

6 Ibid.

7 https://open.alberta.ca/dataset/423df5de-6562-4b06-9ccb-596e9d130bb5/resource/1128ae16-d050-4a98-860c2e503d84a677/download/sh-2021-income-threshold.pdf

8 https://www.canada.ca/en/services/benefits/publicpensions/cpp/old-age-security/guaranteed-income-supplement/apply.html#h2.2-3.1

9 https://static1.squarespace.com/static/5c2fa7b03917eed9b5a436d8/t/5e41c25873b8a7233f398b72/1581367901417/Improving-Canada-sRetirement-Income-System-Setting-Priorities_final.pdf

10 https://www.ic.gc.ca/eic/site/eas-aes.nsf/vwapj/SRIsr02.pdf/$FILE/SRIsr02.pdf

2022 Provincial Policy Resolutions

Our Chamber had the following policy resolutions approved by the Alberta Chambers of Commerce network at the 2022 ACC Annual General Meeting in Lethbridge.

Sponsored by: Grande Prairie

Co-sponsor(s):

ISSUE

Labour shortages, already a pressing issue for Canadian businesses before the COVID-19 pandemic, are growing and new ones emerging. Yet Canada’s Guaranteed Income Supplement (GIS) and the Alberta Income for the Severely Handicapped (AISH) program claw backs are creating barriers to labour market participation for many employable older adults and for persons with disabilities. This is increasing labour market pressures, negatively impacting these citizens’ quality of life, and limiting Canada and Alberta’s potential economic output.

RECOMMENDATION(S)

The Alberta Chambers of Commerce recommends the Government of Alberta:

1. Work with federal, provincial and territory governments, industry and academia to create a modern framework for RIS that includes undertaking a comprehensive review of the GIS income thresholds and claw back rates to allow for higher earnings exemptions and income thresholds, which will incentivize older Canadians to voluntarily delay receiving RIS, delay retirement or enter the labour force after retirement;

2. Undertake a comprehensive review of the AISH claw backs, striving for a model that allows for higher earnings exemptions and income thresholds before claw backs to incentivize AISH recipients to enter or remain in the labour force; and

3. Ensure reform encourages and allows as much participation as possible in the workforce for GIS and AISH recipients, helps these individuals stay out of poverty, and allows them to maintain or improve their standard of living.

BACKGROUND

Retirement Income System (RIS) and Barriers to Employment

Canada’s RIS (which includes GIS) functions on many of the assumptions that we had decades ago. Though some reforms recently have been introduced, innovation to Canada’s RIS programs has been slow, especially in light of the evolving economic, demographic, social and labour market context. Research posits that a lack of integrated political decision-making, regulation and research is restricting RIS innovation.

When Canada’s public pension programs were designed over 50 years ago, the average age of the population was under 30. We’re now on average over 40-years-old and living longer. About 23% of the working age population will be 65 years or older by 2024. Between 2021-2024, Canada will lose about 600,000 workers as people age and exceed 65-years-old, lowering the share of the population participating in labour markets.

Further, many Canadians now face personal ¬financial uncertainty. Forty years ago, almost half of working Canadians had some form of pension coverage. Today, only about one-third do. Faced with living longer and fewer savings, worries about “inadequate savings for retirement, outliving their money, and affording health services that are not universally guaranteed (such as long-term care)” are more prevalent.

What is concerning is that while Canada is experiencing a declining labour force and Canadians are facing increasing costs of living and inadequate savings for retirement, research shows features of Canada’s public retirement income system have significant work and income earning disincentives for older workers. The greatest impact is on recipients of Guaranteed Income Supplement (GIS), a government program intended to support low-income seniors.

Basic Old Age Security (OAS) is a monthly payment available to all Canadian residents aged 65 and over. GIS is based on income and is available to low-income OAS recipients. A single senior qualifies for GIS if their income is below $19,464; couples qualify if their combined income is below $46,656.

These thresholds are meant to provide “floors” to keep people out poverty. To provide greater context for GIS thresholds, the thresholds to meet “low-income status” for Alberta’s Community Housing Program are much higher: $25,500 to $43,000 (bachelor, 2021), depending on where you live. This represents the minimum income required to meet basic needs in different municipalities throughout Alberta.

What is discouraging low earning seniors from saving for retirement and taking employment is that GIS benefits are reduced or clawed back for other income earned, including employment and self-employment income, above $5,000 per year. For earnings between $5,000 and $15,000, GIS will be reduced by 50 cents for every dollar of income received.

Further, because GIS is based on previous year’s income, the effect of earning additional income can be experienced for up to two years. For example, if an individual receiving GIS earns other income over $5,000 in 2020, the GIS for that year is clawed back after they file their 2020 taxes and they will continue to lose the monthly benefit amount until they file their 2021 tax return showing no additional income. Although GIS is paid retroactively for qualifying years, the loss of GIS income for an entire year can have significant impact on quality of life during that time period.

In addition, other provincial income supplements, and health and basic needs programs are also restricted if the individual earns income. Although these individuals are in need of additional income to meet basic living expenses, the risk of losing benefits creates a major disincentive for earning additional income through part-time employment.

Reform of GIS claw back mechanisms to incentivize older workers to participate in the labour force aligns with recommendations from the Melbourne-Mercer Global Pension Index (MMGPI), which benchmarks and ranks retirement income systems across the world. In 2019, MMGI made three recommendations for improvement to Canada’s RIS. One of those is: “Increase labour force participation rates at older ages as life expectancy increases.”

When Canadians work longer there are numerous benefits to the economy and workplaces:

• Modeling shows that the impact to Canada could be substantial in terms of extra labour supply and real output and would result in a substantial increase in living standards.

• Studies show that 1) older workers’ accumulated knowledge, leadership skills and high job match quality contribute to high productivity; and, 2) since experience is a key element in the commercialization aspects of innovation, an older workforce may increase this dimension of innovative capacity.

• More seniors working drives economic growth and generates tax revenue for government.

Alberta Income for the Severely Handicapped (AISH)

AISH was established to support Albertans with a disability who are unable to solely support themselves through work. Yet while many Albertans with disabilities wish to be employed, the existing claw back mechanism on AISH funding, similar to those claw backs for low-income seniors discussed above, is making it difficult for Albertans with disabilities who may be willing and able to integrate into the workforce to do so. Many AISH recipients have to keep earnings low enough to stay on AISH, in order to receive their maximum eligible amounts and to continue to be eligible for the medical services they need.

Albertans with disabilities not working and receiving AISH receive $19,056.47 annually, which does not provide enough money for basic necessities. A University of Calgary study, for example, found that the cost of support required by many individuals diagnosed with Autism Spectrum Disorder (ASD) is “well beyond what the individuals with ASD and their families could pay for out of annual income, giving many no choice but to stay on AISH.” As a result, rather than integrating into the workforce, these Albertans remain in a cycle of dependency on the government. So despite having high levels of education and an availability of workers, data shows that persons with disabilities are highly underrepresented in the workforce.

Social assistance programs can contribute not only to a healthier and more productive population but to a healthier labour market. Key to achieving these goals is reform to the low-income amounts provided to AISH recipients and to the claw back rates to facilitate entry into the workforce for Albertans with disabilities.

A more modern framework to reduce the cost of participating in the workforce

It is in the best interest for individuals, communities, the government and the economy to ensure all productive and capable individuals have access to the labour market. Policy to eliminate current barriers for GIS and AISH recipients to remain in or enter the labour market is critical. Such reform will reduce the cost of working, and encourage and allow as much participation as possible in the workforce for those who are able – helping drive a healthy and diverse labour market. It will also generate long-term cost savings to the government as recipients leave the programs or rely less on them.

Sponsored by: Grande Prairie

Co-sponsor(s):Drumheller

ISSUE

The cost of transmission and distribution of electricity to customers has created disparity in pricing across Alberta. Extremely high power bills in some parts of the province are mainly driven by higher distribution charges. Distribution costs are higher in rural and northern service areas, with consumers in these areas paying up to 400% more for distribution services compared to consumers in urban service areas. Moreover, with customers in Saskatchewan and British Columbia paying significantly lower electricity rates than customers in most of Alberta, Alberta’s overall competitiveness and ability to attract business is further impeded.

RECOMMENDATION(S)

The Alberta Chambers of Commerce recommends the Government of Alberta:

1. Create a tax incentive for utility distribution companies operating outside of Alberta’s two metropolitan areas with the mandate to pass the savings along to customers through reduced distribution delivery rates.

BACKGROUND

Electricity industry structure in Alberta

In Alberta, electrical generation and retailing make up the de-regulated sectors of the market while transmission and distribution are government regulated sectors. Because electricity delivery is a fully regulated service, the Alberta Utilities Commission (AUC) reviews and approves the rates to ensure they are fair and reasonable for Alberta customers. According to its mandate, the AUC considers and protects the social, economic and environmental interests of Alberta where competitive forces do not.

However, depending on where you live or operate a business in Alberta, there is disparity in these charges: residential, farm and commercial customers in rural and northern areas pay significantly higher electricity costs than those in more urban areas. Charges for distribution are higher in rural and northern areas because of the low population density and longer distances between consumer sites. A distribution system that serves rural areas costs more than those serving urban areas because there are longer distances between customers; the utility must build, operate and maintain more poles, wires and facilities to serve each customer; and there are fewer customers on systems in rural areas sharing the costs.

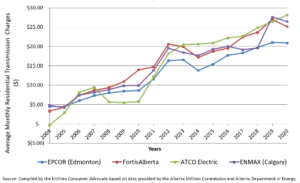

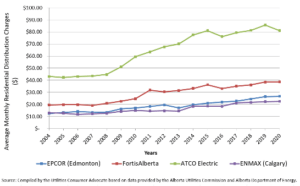

As shown in figures A and B, distribution and transmission charges are highest in ATCO’s service area, followed by FortisAlberta’s service area. ATCO primarily serves northern Alberta and parts of eastern Alberta. FortisAlberta serves the south and western more rural areas of Alberta. (A recent analysis shows that electricity prices in Alberta in 2021 were more than double the Alberta power pool price seen in 2020, and costs will remain elevated in 2022.)

Breaking down the charges: Transmission and Distribution

Energy delivery charges in Alberta include two components: transmission and distribution (in addition to rate riders). Transmission charges cover the cost of moving electric energy from generating facilities through high-voltage transmission lines to the distribution system. Charges are based on the electricity used by the consumer, and make up between 14% to 20% of a customer’s total bill. In 2020, monthly transmission charges paid by the average residential customer with 600kWh of consumption ranged from $20.88 (EPCOR’s service area) to $28.19 (ATCO’s service area).

Distribution charges cover the cost of moving electric energy from substation transformers through local, lower-voltage lines that carry electricity to a customer’s meter. These charges make up between 22% and 47% of a customer’s total bill. In 2020, monthly distribution charges paid by the average residential consumer with 600kWh consumption ranged from $22.55 (ENMAX’s service area) to $81.11 (ATCO’s service area). Consumers in the ATCO zone can pay twice as much for distribution compared to rural consumers in the ForisAlberta zone, and nearly 400% more than residential consumers in Calgary.

Figure A - Average monthly transmission charges for residential RRO customers, by service area

Figure B – Average monthly distribution charges for residential RRO customers, by service area

Alberta’s current electrical system creates further economic penalties for Alberta ratepayers

While disparities in electricity rates exist within Alberta, much lower electrical transmission and distribution rates in both Saskatchewan and British Columbia are also impacting Alberta’s ability to attract and retain business. Alberta business owners with property in the two neighbouring provinces report paying much lower rates in Saskatchewan and BC. While this impedes economic growth and development in rural communities along provincial borders, it also puts Alberta at a competitive disadvantage.

In addition, as electricity costs increase, consumers are exploring other alternatives. According to a recent AUC study, an increasing number of industrial facilities have been installing their own generation sources and individual Albertans and small businesses are doing the same. With fewer customers to share costs of the electrical system, remaining electricity customers, particularly those in areas of low customer density, may be further penalized by the even higher rates. Further, as Alberta moves towards electrifying the grid, and as demand for electricity puts even greater pressure on the electricity system, the result will mean even greater disparities in pricing.

Conclusion

Higher electricity rates in certain areas of the province don’t just threaten industry and businesses in that region but impact all of Alberta. Alberta’s North, for example, has an abundance of resources with high global demand. Its economic contributions to the whole of Alberta and Canada are significant: the area contains much of Alberta’s natural resources, specifically, 100% of the oil sands deposits, 86% of forests, both conventional oil and natural gas production, about 28% of Alberta’s total farm area, as well as the associated opportunities in value-added and emerging technologies. The ripple effect of economic impacts from higher electricity costs faced by these northern industrial operations cannot be ignored.

An electrical system that creates a fair playing field for the delivery of affordable electricity to Alberta homes, farms, businesses and industry is critical not only for all Albertans’ well-being but for the strength of Alberta’s economy and overall competitiveness. Further consideration must be taken to developing such a system that does not penalize communities and business owners based on their geographic location – one that protects the social, economic and environmental interests of all Albertans.

Sponsored by: Grande Prairie

Co-sponsor(s): Drumheller

ISSUE

Alberta’ electricity sector is rapidly undergoing transformation, most notably influenced by the drive toward net-zero emissions and the demands of the increased electrification of other sectors of the economy. Alberta’s future depends on the successful restructuring of the province’s electricity system, not only to support the massive ramp-up of clean electricity required, but to ensure Albertans are not faced with soaring electricity costs that would threaten industry and business and citizen well-being. A clear, transparent and phased plan for a path forward is urgently needed – one that strikes a balance between the addition of renewable energy sources while encouraging investment and economic growth.

RECOMMENDATION(S)

The Alberta Chambers of Commerce recommends the Government of Alberta:

1. Develop and openly share a comprehensive plan to transform Alberta’s electrical system into the future. The plan should:

a. Be informed by industry, stakeholders, energy transition research centres and the Alberta Electric System Operator (AESO) working collaboratively to understand the potential pathways and implications to a net-zero grid of the future;

b. Be informed by analysis of the costs of implementing renewable energy;

c. Ensure Albertans have access to a reliable supply of power at affordable rates;

d. Ensure Alberta’s price of electricity enhances, not detracts from, our ability to compete globally and attract investment;

e. Support working with other provinces, the federal government, and the United States to grow, better integrate and optimize the electricity grid;

f. Support a phased approach that does not place rapid significant increases in rates on end-use customers;

g. Have the flexibility to mitigate potential adverse impacts and respond to changing market conditions;