Home // Our Advocacy

Our Advocacy

We have been the voice of business in Grande Prairie & District for more than a hundred years!

2025 National Policy Resolutions

- World demand for Canada’s natural resources is rising and will continue to rise in the coming years. However, the federal government’s cap on emissions and imbalanced carbon levy on large emitters are not globally competitive and are preventing our producers from seizing the opportunity, and the Impact Assessment Act (2019) is stifling the progress of important projects. To maximize the opportunity for Canada’s economic growth, these regulations need to be revisited.

2025 Provincial Policy Resolutions

Our Chamber sponsored or co-sponsored the following policy resolutions which were approved by the Alberta Chambers of Commerce (ACC) network at the 2025 ACC Annual General Meeting and Policy Session in Medicine Hat.

Policies are shared with government officials for follow up and discussion with the goal of eventual implementation based on the recommendations of our network. Policy development is based on feedback from our member businesses.

Alberta’s Role in Enhancing Interprovincial Collaboration

Issue

Alberta’s economic growth and competitiveness are hindered by interprovincial trade barriers and inconsistencies in labour mobility agreements. These barriers create inefficiencies in supply chains, increase costs for businesses, and limit opportunities for workers to move freely across provinces. By promoting stronger interprovincial partnerships, Alberta can foster a more seamless and competitive economy, ensuring businesses and workers benefit from a unified national market.

Background

Canada’s Constitution Act of 1867 emphasizes the importance of free trade among provinces, yet significant barriers persist. Studies have shown that interprovincial trade barriers cost the

Canadian economy billions annually. In Alberta, businesses face challenges such as differing regulatory standards, inconsistent transportation rules, and fragmented labour credential

recognition. These hurdles impact industries ranging from agriculture and manufacturing to construction and technology.

Canada's federal system, while a defining feature, often limits the country’s ability to fully maximize and evenly distribute economic benefits, particularly due to interprovincial trade

restrictions. Despite advancements in international trade since 1989, internal trade has lagged, with significant barriers persisting. The Agreement on Internal Trade (AIT) of 1995 and its

successor, the Canadian Free Trade Agreement (CFTA) of 2017, made progress by adopting a more inclusive "negative list" approach, yet substantial non-tariff barriers remain. These

barriers—ranging from prohibitive restrictions on specific goods, such as alcohol, to technical and regulatory differences—hamper labour mobility, stifle competition, and limit productivity. The economic cost is significant, with estimates suggesting that fully liberalizing internal trade could boost Canada’s GDP by 4%, or $92 billion annually, equivalent to major federal benefit

expenditures in 2018-2019.198

Labour mobility is critical issue. Workers with credentials in one province often face delays and additional costs to have their qualifications recognized elsewhere. This misalignment exacerbates labour shortages, particularly in high-demand sectors like healthcare, construction, and engineering. Addressing these issues requires Alberta to take a leadership role in advocating for greater interprovincial collaboration. The Montral Economic Institute criticized Alberta’s stance on labour mobility, highlighting that the province has the highest number of professional exceptions under the Canadian Free Trade Agreement, limiting workers' ability to transfer credentials without significant additional requirements. While Alberta recently enacted the Labour Mobility Act, streamlining approval processes for over 100 professions, the MEI noted that gaps remain, particularly in health-related sectors facing critical labour shortages, such as nurses, paramedics, and dental hygienists. The institute emphasized the need for Alberta to eliminate exceptions and fully utilize its growing workforce, especially as Canadians increasingly migrate to the province.199

In 2024, 88% of small businesses in Canada view eliminating interprovincial trade barriers as a top priority, citing significant challenges in navigating regulatory differences that hinder growth and expansion. Half of businesses report that these barriers make it easier to operate in the U.S. than within Canada. Despite the Canadian Free Trade Agreement (CFTA), progress has been slow, with regulatory hurdles, fees, and paperwork continuing to impede the free flow of goods, services, and labour. These barriers exacerbate Canada’s productivity crisis, which ranks second to last among G7 countries, and worsen economic challenges like high business costs, inflation, labour shortages, and sluggish growth. Removing these barriers could offer businesses and consumers increased choices, more efficient supply chains, lower prices, and improved labour mobility. Economic estimates suggest that eliminating internal trade barriers could boost Canada’s economy by $200 billion annually, equivalent to $5,100 per person.

Alberta has made significant strides in reducing interprovincial trade and labour mobility barriers, building on agreements like the Canadian Free Trade Agreement (CFTA) and the New West

Partnership Trade Agreement (NWPTA). However, varying provincial commitments and gaps in implementation have limited the full impact of these frameworks. Alberta, with its strong

foundation, is well-positioned to drive further progress by leveraging federal initiatives such as the Canadian Internal Trade Data and Information Hub and the removal of 14 CFTA exceptions.

Notably, Alberta’s B+ grade (8.6) in this year’s interprovincial cooperation report card published by Canadian Federation of Independent Business highlights its leadership, second only to Manitoba. Alberta can look to innovative measures from other provinces, like Nova Scotia’s portable registration model for health care professionals, to enhance its labour mobility strategies. Continued engagement with tools like the Regulatory Reconciliation and Cooperation Table’s (RCT) online portal for addressing regulatory barriers offers Alberta an opportunity to further align policies and strengthen its economic integration within Canada.200

The Alberta Chambers of Commerce recommends the Government of Alberta:

1. Streamline the recognition of credentials from other Canadian jurisdictions, reducing delays and costs for workers in order to improve workforce mobility and address sectoral labour shortages. Do this unilaterally and without reciprocation from other provincial governments;

2. Align standards and regulations with other provinces in transportation, agriculture, and construction to reduce inefficiencies. During this process, recognize standards and regulations

from Canadian jurisdictions as appropriate for Alberta; and,

3. Use agreements like the Canadian Free Trade Agreement and New West Partnership Trade Agreement to enforce trade commitments and promote mutual recognition of goods and

services.

198 https://journalhosting.ucalgary.ca/index.php/sppp/article/download/72793/55777/228204

¹⁹⁹ https://calgaryherald.com/business/alberta-interprovincial-trade-labour-mobility-montreal-economic-institute- ranking

200 https://www.cfib-fcei.ca/hubfs/research/reports/2024/2024-07-internal-trade-report-card-2024-en.pdf

The Road to Better Trade: Reducing Interprovincial Trade Barriers in Trucking

The Issue

Improved interprovincial trade could result in significant growth opportunities for Alberta business. These improvements can be achieved by removing barriers such as those which add costs and delays to transport trucking. The Government of Alberta should work to harmonize its regulations, standards, and infrastructure with other provinces to remove these barriers. The Government of Canada should work to support and coordinate this harmonization process across all federal partners.

Background

Reducing interprovincial trade barriers presents a significant opportunity for economic growth in Alberta and Canada as a whole. Eliminating these barriers could lead to a 3.2% annual increase in Alberta's GDP317. Furthermore, interprovincial trade barriers add between 8% and 14.5% to the price of goods and services in Canada, increasing business costs and limiting growth potential318.

One particularly important interprovincial trade barrier is the misalignment of various standards, regulations, and infrastructure related to transport trucking. The commercial trucking industry is a crucial component of the provincial and national supply chain, with 90% of Canada’s 72.9 million freight shipments being carried by trucks319. Albertans and consumers across Canada rely heavily on freight transportation to provide them with daily necessities. In fact, 52% of Alberta’s Gross Domestic Product is delivered via trucking320.

Regulatory Harmonization

Each province in Canada maintains jurisdictional authority both over highway infrastructure and the regulatory framework governing trucking including driver standards, vehicle requirements. This result of this federal system is a patchwork of regulations, navigating which creates additional costs for shippers. While some efforts have been made to harmonize these

standards321, they have not reflected a coordinated effort to align all areas of trucking governance between all provinces.

The Canadian Trucking Alliance (CTA) has identified specific areas where regulatory alignment would have the most impact³²². The Government of Alberta should work with other provincial

governments to align and harmonize:

• standards for driver training,

• permit conditions and licenses for long combination vehicle programs and for oversize/overweight

equipment,

• minimum clearance requirements for construction zones,

• regulatory definitions such as for “sunrise” and “sunset”,

• and spring weight restrictions and road bans.

Regarding special permit applications such as for oversize/overweight equipment shipments, a unified electronic permitting system would allow shippers to obtain appropriate permits faster and allow provincial authorities in different provinces to coordinate and regulate these types of shipments more easily. Such a system could allow applicants to obtain permits from the appropriate province but would be centralized in a single application.

Trucking Infrastructure

Other challenges relate to differences between provinces in infrastructure.

The CTA has noted that throughout Canada, segments of the National Highway System (NHS) lack rest stops at recommended intervals (approximately every 80 km to 160 km). As drivers have hour-of-service obligations limiting their driving time each day, a lack of access to rest stops results in drivers having to stop earlier than optimal to ensure they have safe and legal places to park their trucks. In Alberta, an example of inadequate highway segment on the NHS is on Highway 35 between Peace River and High Level (295 km without a rest area) and Highway 40 between Grande Prairie and Grande Cache (190 km without a rest area).

Currently variations in bridge heights throughout the country create uncertainty for long-haul shipping routes, setting and adhering to a national minimum standard for new bridge construction nationwide would improve operational predictability and lower administrative costs of finding routes which navigate the variations in bridge heights.

The Alberta Chambers of Commerce recommends the Government of Alberta:

1. Lead collaborative efforts with other provinces and territories in consultation with industry to harmonize regulations, standards, and infrastructure while urging the federal government

to support and coordinate national alignment initiatives.

The Alberta Chambers of Commerce recommends the Government of Canada:

1. Promote the creation of harmonized trucking standards and regulations between provinces and territories by facilitating regulatory discussions between all provincial/territorial

governments in Canada;

2. Develop a national electronic permitting system for oversize/overweight equipment in partnership with provincial governments to create a single application for all provincial

permits; and,

3. Establish a national standard for minimum heights for new bridge construction.

317 Deloitte LLP. (November, 2021) The case for liberalizing interprovincial trade in Canada.

318 Globerman, Steven. (November 1, 2024). The Growing Imperative to Create a More Integrated Internal Economy in Canada. The Frase Institute

319 Statistics Canada. (2017). Commodity flows by mode in Canada: Canadian Freight Analysis Framework, 2017.

320 Groves, Jude. “We need more commercial drivers to keep Canada moving.” Edmonton Journal, October 28, 2021

321 Task Force on Vehicle Weights and Dimensions Policy. “Harmonization of Special Permit Conditions for Long Combination Vehicles (LCV). https://comt.ca/english/programs/trucking/Western.htm

322 Canadian Trucking Alliance

Improvements to Regional Air Service

Issue:

The Regional Airports in Alberta are left to primarily rely on a single air service provider for passenger flights. This situation imposes several barriers to increasing load capacity for flights, including airfare premiums; wait times for connecting flights; flight frequency; flight consistency and reliability; limited destination options.

Background:

Since 2019 regional air service suffered significant declines, serving approximately 35% of its peak traffic from 2019. Issues such as inconsistent and unreliable flights, long connection times, and reduced flight frequency have caused passengers to opt for the main travel hubs in Calgary or Edmonton instead.

Most passengers prefer to fly from their own region if flights are available with reasonable fares and convenient departure/connection times. Avoiding parking in larger centers and reducing travel distances are significant incentives for regional air service. However, long layovers and poor connections diminish these advantages, making nearby airports like Edmonton, Calgary or even neighbouring provinces more attractive despite their distance.

A 2023 survey showed that 85% of passengers use the large urban airports due to better schedules and fares with 75-80% loss of passenger traffic in regional areas. However, businesses have indicated a strong preference to regional flight service and a need for improved air connectivity to promote growth and economic development activity, as losing air service has proven to be a significant barrier to growth.

Regional air transportation is crucial to local economic growth, the movement of goods and the connectivity of Canadians across the country. The pandemic has had major impacts on regional air transportation ecosystems, affecting communities and local businesses from coast to coast to coast.

The Federal Government launched Canada’s Regional Air Transportation Initiative (RATI) in March 2021 to foster access to air transportation and support regional ecosystems. However, other provinces have also contributed to funding regional airports for infrastructure improvements to support capacity, maintain and improve service and gain access to essential services and economic opportunities. Recognizing the need for a multi-level Government approach, strong provincial support of regional air service can also assist in retaining this vital service and economic driver in Alberta.

The Alberta Chambers of Commerce recommends the Government of Alberta, working with regional airport authorities and municipally owned airports:

1. Aggressively pursue alternate options for increased flight frequency, improved connectivity, service reliability, and the introduction or reintroduction of flight services in regional airports;

and,

2. Create a funding pool to support regional air carriers if passenger load factors or revenues do not meet minimum targets. This funding would help stabilize regional air service and

connectivity, ensuring regional Airports can better serve its catchment area until such time that the load capacity can increase for business and personal travel.

2024 Provincial Policy Resolutions

Our Chamber sponsored or co-sponsored the following policy resolutions which were approved by the Alberta Chambers of Commerce (ACC) network at the 2024 ACC Annual General Meeting and Policy Session in Red Deer.

Policies are shared with government officials for follow up and discussion with the goal of eventual implementation based on the recommendations of our network. Policy development is based on feedback from our member businesses.

A Tailored and Local P3 Approach to Affordable Housing

Issue

Pressure on affordable housing across Alberta and Canada is growing. It is neither feasible nor sustainable for governments to address the issue on their own. P3 (Public-Private Partnership)

models show the greatest potential to address the magnitude of the issue while creating a sustainable program. By activating the private development sector, more affordable housing units can be rapidly brought on stream to meet demand. This can be accomplished by incentivizing developers to participate in projects that combine affordable and market-value housing.

Background

Current situation in Alberta

Over 690,000 Albertans spend more than 30% of their before-tax household income on housing costs53 and 9.9% of households are in core housing need54, which is unaffordable according to the standard for affordability. As of April 2021, more than 110,000 low-income Albertans live in affordable housing and more than 24,000 are on a waitlist.55 Waitlists are growing due to population increase and demographic changes. Additionally, the economic impact of COVID-19 is challenging the financial sustainability of Alberta’s affordable housing system.

Lack of sufficient affordable housing contributes to homelessness and has socio-economic costs for communities. These include, but are not limited to, health issues and educational disadvantages for vulnerable individuals and families, increasing household debt, poorly maintained properties, crime, addictions, challenges attracting labour, and more.

A Sustainable and Innovative P3 Model

Municipal housing authorities currently use a number of housing acquisition models to address affordable housing needs. These include new construction, purchase of existing building, long-term leases, direct-to-consumer subsidies and landlord subsidies linked to specific units. More recently, P3 models are being undertaken for construction projects of new and refurbished housing units.56

Regardless of the strategies employed, municipalities need the flexibility to decide which model works best for them and, more importantly, need access to funding from the provincial and federal governments who have the responsibility of addressing affordable housing needs.

P3 models show the greatest potential to address affordable housing needs in a sustainable way. Private sector developers can move more rapidly to construct affordable housing units to meet the rate at which the core needs housing problem is growing. This is accomplished by incentivizing the developer to participate in projects that combine affordable and market-value housing. Benefits of a blended model also include improved geographic distribution of housing and better mixed-income models that provide dignity for those in need of affordable housing.

The proposed P3 model offers an easy-to-implement solution that can help address affordable housing demand. It includes an incentive for developers to construct additional market-value housing units to temper future inflation and contribute to the municipality’s tax base for municipal services. In addition, this P3 model is scalable, transferable to other regions, and sustainable in the long-term while leveraging partnerships and reducing risks for the municipalities and all government partners.

A key element of the proposed P3 model is that housing projects that receive grants under these programs remain fully taxable to the municipality and the province because the property is not government or not-for-profit owned and operated.57 Development incentive grants created by municipalities can be in the form of cash, land, waiver of fees or other incentives that directly reduce the cost of development. In situations where cash incentives are required, municipalities should have the ability to borrow from the province at a sub-prime interest rate with the understanding that the Province will receive its return through taxes on the full assessed value of property. A return on investment for the province is therefore realized through a combination of repayment of principal by the municipality and property taxes by the developer.

Sample Analysis

• Developer receives a municipal affordable housing incentive totaling 10% of a $10 million construction project. The actual program may vary from municipality to municipality.

• Municipality borrows the $1 million from the Province to incentivize the development.

• Rental rates for the affordable housing units are set under the same guidelines as Canada Mortgage and Housing Corporation (10% below revenue potential).

• Typical provincial mill rate is $2.44 and based on a $10 million assessment, this generates $24,400 in annual taxes to the Province. This is equivalent to a 2.44% annual rate of return

to the Province.

• The rate of return for the municipality is dependent on the incentive program it creates and based on its portion of property tax collected.

Conclusion

This proposed model of P3 demonstrates an alternative approach that is innovative, can be easily implemented, and is sustainable in the long-term while leveraging partnerships and reducing risks for the municipalities and all levels of government involved. It allows government to focus resources on higher level strategies, directing provincial and federal grants to the more immediate/acute need of supportive housing. These outcomes align with Alberta’s 10-year strategy to improve and expand affordable housing (2021), which recommends expanding affordable housing through a range of models and capital contributions; flexibility; innovation; and partnerships among all orders of government, communities, non-profit organizations, and the private sector.58

The Affordable Housing Review, which led to the strategy, supports government investment in affordable housing as “[the investment] is multiplied in economic returns because it creates jobs and supports tenants to stay in their community and obtain and maintain meaningful employment.”59 To engage private developers in affordable housing P3 projects, municipalities may require cash commitments. The Alberta government plays an integral role in this partnership and strategy by providing municipalities with access to a sub-prime interest rate loan. These loans give municipalities the flexibility to tailor solutions that work best within their respective communities and offer another tool to address the affordable housing crisis. Such an investment by the Province is low risk, has a negligible budgetary impact, will see value for P3 partners and better outcomes for all Albertans, and will help drive recovery of the Alberta economy.

The Alberta Chambers of Commerce recommends the Government of Alberta:

1. Support a sustainable and locally tailored P3 approach to address affordable housing demand that actively engages private sector developers by giving municipalities the ability to borrow

from the Province at a below prime interest rate, with the understanding that the Province will receive return through taxes on the full assessed value of property.

53 https://ascha.com/assets/advocacy/current/KeyMessagesHousingSupportsAlberta.pdf Census 2021

54 https://www12.statcan.gc.ca/census-recensement/2021/as-sa/fogsspg/alternative.cfm?topic=7&lang=E&dguid=2021A000248&objectId=4g Core housing need: Does not meet one or

more standards for housing adequacy (repair), suitability (crowding), or affordability, and has to spend 30% or more of its before-tax income to pay the median rent (including utilities) of appropriately sized alternative local market housing.

55 Stronger Foundations: Alberta’s 10-Year Strategy to Improve and Expand Affordable Housing, 2021.

56 The Canadian Council for Public-Private Partnerships defines P3 as public-private partnerships that include arrangements where development is undertaken with a combination of not-for-profit, private and public participations of programs.

57 Section 362(1)(n) Municipal Government Act Parts 1 and 3 of AR 281/98

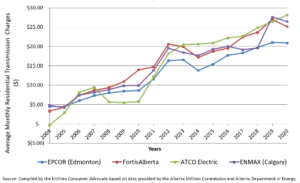

Strengthening Alberta’s Electricity Transmission Intertie Infrastructure

The Issue

Affordable, reliable electricity is critical to the sustainability of the Canadian economy.

Background

Reliable and affordable electricity are essential components of a well-functioning, competitive economy. Provincial interties are a key aspect of Alberta’s integrated transmission system, with

three operating in Alberta (connecting to B.C., Saskatchewan, and Montana). These interties enable the import and export of electricity from neighbouring jurisdictions to both support Alberta’s robust, competitive, energy-only market and provide system reliability, which is of utmost importance to residential, farm, and small business and industrial consumers throughout the province. Alberta is currently the least interconnected province in Canada as a percentage of electrical load.

On January 14 and 15, 2024, Alberta Electric System Operator issued provincewide grid failure warnings due to increased demand caused by extreme cold. These warnings requested that residents and businesses limit their consumption and were not only disruptive, but they were also potentially economically costly due to possible lost productivity because of interruption to business operations.

Record low temperature brought record high demand for electricity. And renewable energy sources could not keep up. There was no wind on the weekend and the sun set before peak demand. To make matters worse, four natural gas-powered plants failed. Prior to the shortages, there was strong wind generation, backed by steady supply from natural gas-powered plants.138

In addition, recent years have seen the AESO has imposed a significant reduction in import capacity (curtailment) for the Montana and B.C. interties, which is having a negative effect on transmission system operations and, more importantly, is leading to an estimated $300 to $500 million in additional costs annually for Alberta electricity consumers.139

These potentially disastrous situations could be avoided, and costs reduced with increased and more robust transmission intertie infrastructure.

Berkshire Hathaway Energy Canada’s Montana-Alberta Transmission Line (MATL) Intertie Enhancement Project

The Montana Alberta Transmission Line (MATL) is a 344-kilometer, 230 kV 300 MW merchant transmission line connecting Great Falls, Montana and Lethbridge, Alberta. Analysis by Berkshire

Hathaway Energy Canada shows that having a 450 MW back-to-back DC converter on the MATL intertie would increase transfer capacity for both the B.C. and MATL interties, optimizing the intertie system and improving grid reliability to help avoid future blackouts. With the support of the Canada Infrastructure BHE UST is developing a potential project to increase MATL’s capacity from 300 MWs to 500 MWs. Upgrades have been discussed for several years, yet no action has been taken.140

It is anticipated the additional capacity of the MATL intertie enhancement project would result in AESO easing the current curtailment, in turn leading to significant cost benefits for Alberta

electricity consumers. In addition to reducing electricity costs for rate payers, the project would generate an estimated $2.4 to $3.1 million in property taxes in Lethbridge or Warner County,

substantial tax revenue for Alberta, and employment opportunities for First Nations. The project would produce more than 200 construction and engineering jobs during build out and result in five full-time operations jobs when complete.

Expanding intertie infrastructure is of strategic interest to Alberta and Canada’s economic and climate goals.

Alberta’s current intertie infrastructure limits access to hydropower produced in B.C. and Manitoba, as well as access to renewable power produced in southern Alberta and the United States. Interties complement high penetrations of variable renewable electricity by enabling jurisdictions to trade surplus renewable generation with other markets when output is high and to import electricity when output is low.141 Finding ways to improve the transmission system’s reliability, lower electricity costs for consumers, and improve access to renewable energy sources are critical objectives to enable a less carbon-intensive and more sustainable Canadian economy.

The Alberta Chambers of Commerce Recommends that the Government of Alberta:

1. Support private investment in provincial interties to enable competition in Alberta’s energy-only market, lower electricity costs, and improve grid reliability, including BHE Canada’s MATL

intertie and back-to-back DC converter station project; and

2. Promote development of interjurisdictional interties to improve access to electricity produced by renewable resources and increase opportunities for interprovincial and Canada-

U.S. electricity trade.

¹³⁸ Alberta’s electrical grid is overloaded. Here’s what to know. (https://ppforum.ca/policy-speaking/whats-wrong- with-albertas-overloaded-electrical-grid/)

¹³⁹ AESO’s curtailments of the Montana-Alberta- B.C. interties cost Alberta consumers $70 million in the first 46 days.

140 2023 Fixed-Income Investor Conference. Berkshire Hathaway Company (https://www.brkenergy.com/content/published/api/v1.1/assets/CONT9F21419F1BA744AEB8F28E5DF45C0A56/native?cb=_cache_41f1&download=true&channelToken=43656b04884643bc9fe334ad550d375f)

141 Strategic Electricity Interties Report of the Standing Committee on Natural Resources 2017 (https://www.ourcommons.ca/Content/Committee/421/RNNR/Reports/RP9335660/rnnrrp07/rnnrrp07-e.pdf)

2023 National Policy Resolution

The Grande Prairie & District Chamber of Commerce submitted the following policy resolution to the Canadian Chamber of Commerce:

"Flexible Solutions to Address the Gap in Immigration Biometric Services"

This submission was debated and voted on by Chambers from across the country during the Canadian Chamber of Commerce 2023 AGM & Convention: Energizing Canada's Future on October 13-14 in Calgary and we are pleased to announce that it was passed nearly unanimously with 98.58% approval.

Sponsor: Grande Prairie & District Chamber of Commerce

Flexible Solutions to Address the Gap in Immigration Biometric Services

Issue

Strong rural economies mean a stronger Canada. Immigration plays a crucial role in growing Canada’s economy and is especially vital for rural communities to grow populations and fill labour shortages. Yet current policy regarding immigration biometric services, a requirement of the immigration process, places undue hardship on applicants in some rural or northern areas in Canada, requiring them to travel long distances and bear the associated travel costs to access this service. Such policy is neither aligned with the federal government’s commitment to address systemic inequities in core institutions and policy development [i] nor its concerted efforts to remove barriers to newcomer attraction and retention in rural Canada.

Background

Many applicants for immigration to Canada, or for a work permit, study permit or visitor status (including extensions), are required by Immigration, Refugees and Citizenship Canada (IRCC) to provide biometrics. Data collected includes electronic fingerprints, digital photograph and biographical data (note: this is not a criminal record check). As of June 14, 2023, updated IRCC policy now requires that anyone applying for permanent residence (PR) must submit biometrics, regardless of if they have previously submitted them (during the pandemic, PR applicants did not have resubmit biometrics if they had submitted biometrics with a temporary resident application within the past decade).

As per IRCC policy, applicants who are applying from within Canada must attend their pre-booked appointment in-person at a designated Service Canada location. The issue is that not all Service Canada offices are authorized to offer immigration biometrics to in-Canada applicants, and those offices not providing this service are predominantly in rural and/or northern Canada. Further compounding the issue is that current IRCC policy does not allow biometric services for in-Canada immigration applicants to be provided outside of Service Canada.[ii]

As a result, some applicants are required to travel, in some cases great distances over multiple days, to access immigration biometric services. They (or an employer willing to absorb the cost) must expend additional funds for travel costs such as hotels, food, gas and time off work. Limited access to public transportation in many rural communities restricts travel options.

Existing literature cites a number of barriers experienced by newcomers in rural areas, including difficulty accessing settlement services due to lack of services, as well as lack of transportation.[iii] These barriers contribute to the economic and social marginalization of newcomers. They also create challenges for the many rural communities and businesses relying on immigration for unmet labour needs, population growth and long-term resilience.

According to the 2022 IRCC annual report, immigration accounts for as much as 90% of labour force growth in Canada and approximately 75% of population growth.[iv] As the large majority of immigrants to Canada settle in urban areas, the Government of Canada is offering several economic initiatives to attract talent to small and medium sized communities and rural areas to help local businesses fill labour shortages. However, Action Canada research found that while these programs have shown success in attracting growing numbers of immigrants, newcomer retention in these communities remains a challenge due to the unique barriers to immigration settlement in rural communities.[v]

The following are two examples of regions in Canada without biometric services for immigration. As key contributors to their provincial and national economies, both regions are actively targeting global markets to grow their workforce:

1) The Grande Prairie region, including the City of Grande Prairie (pop. 70,000), with its abundance of natural resources and growing economy, is actively recruiting an international workforce to fill labour shortages. The City’s Service Canada, however, does not offer immigration biometric services; applicants must make an approximately 1000 km, two-day round trip to Service Canada in Edmonton to access this service, which currently costs $85 per individual. 2) In northern British Columbia, the busiest area of the province due to major construction projects, a global workforce is critical to help fill acute labour shortages. Yet in the City of Fort St. John, for example, to give immigration biometrics, applicants must make a nearly 900 km round trip to Service Canada in Prince George.

The Ministry (IRCC) states “factors involved in selecting biometric service sites include the physical capacity of a given Service Canada location to take on a new service line; the volume of IRCC clients in a geographic area; driving distances between Service Canada locations offering biometric enrolment; and, distances that IRCC clients need to travel to get to the Service Canada location offering biometric enrolments closest to them.” Further, with respect to one of the above examples, the Ministry states that the Edmonton [Service Canada] office was chosen to serve the Grande Prairie region to “minimize the distance to the nearest location for clients.” The excessive travel requirements for the growing number of clients requiring this service do not align with the rationale provided by IRCC regarding how they chose their immigration biometric sites.

Realizing new opportunities in the private sector

As the Government of Canada seeks “to further adapt and develop more agile and effective ways to service Canadians,”[vi] Canada’s private sector offers an opportunity to help fill this gap in biometric services without creating an extra burden for taxpayers. Within the private sector, companies that are accredited through the RCMP's Canadian Criminal Real Time identification Services (CCRTIS) are providing biometric services for civil purposes. (Note: There are no private fingerprinting companies accredited by the RCMP outside of Canada.)

The CCRTIS Program assesses the security and administrative operations of companies that intend to take fingerprints for non criminal purposes. Upon completion of the accreditation process, companies are certified to operate as an affiliate of The Canadian Corps of Commissionaires and authorized to submit electronic fingerprint transactions (non criminal purposes) to CCRTIS via The Canadian Corps of Commissionaires' server. The accreditation process is robust and periodic audits are in place to ensure the integrity of the Program. A company’s accreditation, however, does not authorize it to provide immigration biometrics.

Flexible, innovative, affordable and inclusive solutions

The June 2019 House of Commons report on improving settlement services across Canada, by the Standing Committee on Citizenship and Immigration, highlights the need to remove barriers to settlement services and programs in rural communities across Canada. [vii] The report cites the requirement for flexible and innovative solutions to help attract and retain immigrants in rural communities.

Amending and adapting immigration biometrics policy with consideration to the unique immigration challenges facing rural and more remote communities and to the opportunity that currently exists within the private sector to address service gaps, promotes more equitable and accessible services for all, regardless of location. As Canada’s population ages and birthrates decline, innovative, inclusive and affordable policy solutions supporting the long term integration and retention needs of immigrants in rural and northern communities are critical to helping businesses meet labour needs and ensuring a more productive and resilient economy for Canada.

Recommendation:

That the Government of Canada:

Amend Immigration, Refugees and Citizenship Canada (IRCC) policy to expand the list of eligible providers of immigration biometric services for applicants within Canada, taking into consideration those organizations outside the public sector that are fully accredited organizations through the RCMP's Canadian Criminal Real Time identification Services (CCRTIS), to fill this gap in service across Canada.

[ii] A few exemptions apply. https://www.cic.gc.ca/english/information/where-to-give-biometrics.asp

[iii] https://www.ourcommons.ca/Content/Committee/421/CIMM/Reports/RP10577155/cimmrp26/cimmrp26-e.pdf

[iv] https://www.canada.ca/en/immigration-refugees-citizenship/corporate/publications-manuals/annual-report-parliament-immigration-2022.html#highlights

[v] https://actioncanada.ca/wp-content/uploads/2022/03/Settling-Unsettled-ENG-FINAL-WEB.pdf

Email, June 15, 2023 from S. Charbonneau, IRCC Ministerial Enquiries Division to A. Reimer

[vi] https://pm.gc.ca/en/mandate-letters/2021/12/16/minister-veterans-affairs-and-associate-minister-national-defence?fbclid=IwAR2I1LOAXtRCqOGxOOenZZ9olJJghFVrFC3E5gAUTq1pYKzNhSxDYA55j3Y

[vii] https://www.ourcommons.ca/Content/Committee/421/CIMM/Reports/RP10577155/cimmrp26/cimmrp26-e.pdf

2023 Provincial Policy Resolutions

Our Chamber sponsored or co-sponsored the following policy resolutions which were approved by the Alberta Chambers of Commerce (ACC) network at the 2023 ACC Annual General Meeting and Policy Session in Fort McMurray.

Policies are shared with government officials for follow up and discussion with the goal of eventual implementation based on the recommendations of our network. Policy development is based on feedback from our member businesses.

Investment Attraction for Industrial Zones

Issue

In order for Alberta to compete on the global stage, we need to address issues such as regulatory uncertainty and cost competitiveness so that industry has the tools it needs to maintain a competitive advantage and so that the province and regions can attract new investment opportunities.

Background

The concept of cluster development was introduced in Michael E. Porter’s paper, The Competitive Advantage of Nations published in the Harvard Business Review in the March-April 1990 edition.130 This paper references a study that aimed to determine the differentiating factors in what makes a country successfully competitive on the global scale. It consisted of a detailed, four-year analysis of 10 different countries with different cultures, strategies, and success in various industries. The paper discusses four Determinants of National Competitive Advantage: Firm Strategy, Structure, and Rivalry; Demand Conditions; Factor conditions; and Related and Supporting Industries (p.77). The last determinant references, in essence, cluster development.

Since the time of Porter’s paper, there have been numerous other studies and papers written on the subject. Ultimately, there has been a general consensus on the definition of cluster development as:

“...clusters are widely acknowledged as a type of activity-specific system, situated within broader regional innovation systems, where interaction between actors supports quicker diffusion and absorption of knowledge, more effective innovation and efficient solutions to a range of other localized drivers of competitiveness”. (Wilson et al., 2022).131

This discussion has spurred many local and regionalized innovation hubs and is the underlying basis of the Designated Industrial Zone (DIZ) concept. If there are related businesses located in close proximity to one another with the benefits of regulatory streamlining, there is an increased likelihood of those businesses experiencing a successful outcome.

In 2022, the Alberta Government announced that it would move forward with a Designated Industrial Zone pilot in Alberta’s Industrial Heartland. This project was contingent on six critical factors: formal agreement, coordinated zoning, target size and scale, cluster infrastructure, harmonized permitting, and environmental management. The Industrial Heartland is located in Central Alberta, spread across five municipalities covering a total area of 592km2, and is primarily focused on the petrochemical industry.

Given that Alberta’s Industrial Heartland is the first government partnership of its kind, it can be referred to as a model for future zones. The petrochemical industry was an obvious starting place for the province’s first DIZ as the region had already been identified as a priority for the province132 and industrial development in the region was already taking place. The petrochemical sector accounts for approximately one-third of Alberta's total manufacturing exports, producing 27% of Canada’s chemical output. Contributing $6.8 Billion to the provincial GDP and $6 Billion in exports, Alberta has modern, world-scale plants with access to abundant resource feedstock and efficient transportation systems. There is significant potential for investors who are interested in taking advantage of Alberta’s vast energy resources and new government development programs to build new petrochemical plants in the province.

In addition, industrial manufacturing is a foundational industry that supports infrastructure development as well as energy and natural resource production in Alberta. With world-class expertise and access to global supply chains, Alberta’s industrial manufacturing sector delivers high-value products and services across Canada and around the world. Alberta’s industrial manufacturing industry has key strengths that make the industry competitive and positioned for growth with $2.6 Billion in GDP and $1.3 B in exports, there is opportunity to expand this sector.133

There are environmental considerations that must be noted with such a large area focused on the development of these two important industries. The provincial government has committed to responsible energy development and a sensible approach to environmental protection. In an effort to achieve balance, the Alberta government is actively updating its environmental strategy to address topsoil management guidelines, air emissions requirements, water quality management, environmental assessments, and financial or human resources for implementing environmental management programs134 within the DIZ.

In terms of economic development for the region and the province, EY completed an Economic Impact Study on Alberta’s Industrial Heartland, released in July of 2019135. In terms of the provincial direct, indirect, and induced economic impacts, the combined operational expenditures in the region resulted in $4.476 billion in output, meaning the “total economic activity of new goods and services because of activities occurring within a particular area”. Furthermore, there was more than $1.756 billion in GDP, $1.594 billion in wages, and the equivalent of 23,213 FTEs (p.35) in one year. The capital expenditures over the period of 2017-2020 resulted in $17.243 in output, $10.500 in GDP, and 7,935 FTEs resulting in $1.581 in wages. With a provincial and regional collaboration, there is an expectation that the additional resources put toward streamlining regulation and shared infrastructure while mitigating environmental impacts will contribute to an increase in the measurable economic impact for the region and the province.

While Alberta’s Industrial Heartland is primarily comprised of petrochemical operations, there should be a focus on developing DIZs supporting the development of other industries across the province. The streamlining of provincial regulations is a critical piece to the success of a DIZ and the organizations located within it, and therefore any provincial policy should reflect the niche organizations within the specific DIZ. As referenced by Porter (1998) “The aim of cluster policy is to reinforce the development of all clusters.” "Governments should not choose among clusters, because each one offers opportunities to improve productivity and support rising wages.”136

Given both the studied success of cluster developments in addition to the demonstrated benefit within the Province of Alberta, it is apparent that there is an advantage to cluster development with streamlined regulations within a designated region. Therefore, it should be a goal of the government to facilitate the development of additional designated industrial zones in the province.

The Alberta Chambers of Commerce recommends the Government of Alberta:

- Work with municipalities to clarify the process of obtaining an industrial zone designation in support of expanding the number of industrial zones across our province;

- Assist and facilitate qualifying municipalities to better understand the requirements associated with streamlining regulatory approvals;

- Create a "concierge service" for large industrial projects to remove barriers and guide them through the permitting and regulatory processes while requiring high standards for safety and environmental performance;

- Provide investment attraction support programs with fair and equitable opportunity to any company that meets the eligibility criteria in alignment with existing economic development partners.

130 Porter, M. E. (1990). The competitive advantage of nations. Harvard Business Review. https://hbr.org/1990/03/thecompetitive-advantage-of-nations

131 Wilson, J., Wise, E. & Smith, M. (2022). Evidencing the benefits of cluster policies: towards a generalized framework of effects. Policy Sciences, 55, 369-391. https://doi.org/10.1007/s11077-022-09460-8

132 https://investalberta.ca/industry-profiles/petrochemicals/

133 https://investalberta.ca/industry-profiles/industrial-manufacturing/

134 https://www.alberta.ca/industrial-heartland-designated-industrial-zone.aspx

135 https://industrialheartland.com/wp-content/uploads/2019/07/EYLLP_AIH_EconomicImpactStudy.pdf

136 Porter, M. E. (1998). Clusters and the new economics of competition. Harvard Business Review. https://hbr.org/1998/11/clusters- and-the-new-economics-of-competition

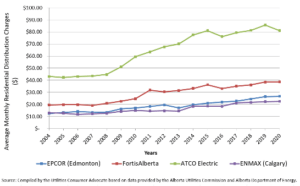

Progressive Regulations to Promote Clean Technology and District Energy

The Issue

Alberta regulations are lagging in making renewable energy and clean technology feasible for consumers. Specifically, the Province’s micro-generation regulations restrict Alberta businesses from aggregating sites owned by customers, in turn restricting their ability to generate and distribute any excess energy directly to other buildings or compound residence (district energy). Adapting provincial regulations to promote self-generation with clean technology and district energy sources is an important climate change strategy for Alberta, and an opportunity to reduce costs and improve competitiveness for Alberta businesses.

Background

Rising demand for electricity in Alberta

Locally and globally, there is an increasing need for electricity, due to a growing demand for air conditioning, electric heating, and electrified transportation, for example. Growing electricity demand will result in higher delivery and electricity prices: upgrades to infrastructure and construction of generation will be necessary, resulting in costs being passed on to consumers.

In Canada, communities account for 60 percent of total energy consumption and half of Canada’s emissions – making them key players in our country’s goal to reduce emissions. And while carbon based fuels will likely remain an important part of our energy system for decades, Alberta has an opportunity to better utilize our fossil fuels by improving the way we use our existing energy sources while transitioning to low and zero emission solutions that are available right now, such as district energy systems.

What is district energy (DE)

District energy systems (DES) use a central energy plant to provide efficient heating, cooling, hot water and power to a group of buildings. Modern systems (climate-resilient and low-carbon) are one of the least-cost and most efficient solutions in reducing emissions and primary energy demand.148 These systems use alternative energy sources, such as wood waste, sewer heat or waste heat, captured from other processes. Typically, DE is almost fully consumed by consumers within that compound, building or subdivision; excess electricity is sold to the grid.

Benefits

DES have a number of benefits that support communities and business:

More cost effective.

Serving many customers from one location, DES have lower operations and maintenance costs than buildings with in-building heating systems. Buildings connected to DES have lower capital costs and smaller footprints and, as such, fewer associated costs (insurance, maintenance, upgrade, etc.).

Reduced carbon footprint.

DES use alternative energy sources and have greater efficiency, producing fewer greenhouse gas emissions than fossil fuel-based systems.

Viable, reliable and readily available technology.

DES are proven technologies, and are already in place in other parts of Canada and around the world.149

Reliable access to energy.

Increasingly faced with electricity brownouts or blackouts from ice, snow and wind storms, floods and fires, low carbon technologies like DES can add to Albertans’ energy security.150

Fundamental to more resilient communities.

Quest Canada, a national non-profit actively working to accelerate the adoption of efficient and integrated community-scale energy systems in Canada, promotes the value of DE technology in building more resilient communities, citing its environmental, economic and reliability benefits. 151

Barriers in Alberta

Current Alberta regulations do not allow a property owner to install generation and sell electricity to the occupants of buildings, compounds or subdivisions. The energy must be sold to the grid through electric distribution system-connected generation (DCG), and then bought back to customers at market rates. Further, while building owners have the option of installing micro- generation, they cannot produce more than what they can consume through their own metering points.

Alberta regulations for small, medium and large business have misaligned incentives for self- generation options. 1). Bulk metering for landlords of commercial retail units and office towers, apartments or large condominium residence is not allowed; 2). There is no incentive for developers of these facilities to install, partner or adapt district energy sources; 3). Micro- generation regulations are restrictive on aggregating sites owned by customers and the distribution of energy is limited at this time; and, 4). Utilities will not allow for building owners to manage the costs of energy for their facilities as rates do not allow such a transaction.

As early as 2017, the Alberta Electric Distribution System-Connected Generation Inquiry identified the need for regulatory change to accommodate growth in the district energy sector in Alberta.152 However, current regulations in the province continue to hamper DES, despite their proven benefits and viability. Furthermore, incentive programs available through Emissions Reduction Alberta, the Municipal Climate Change Action Centre, and other sources do not support funding programs that could benefit DES’ implementations.

As part of its climate change plan, the Government of Alberta has set a target of 30 percent of electrical energy produced in Alberta to be generated from renewable sources by 2030. Progressive policies and strategies in Alberta that promote self-generation with clean technology, such as DES, support an affordable, flexible, reliable and environmentally responsible alternative to energy delivery for Alberta consumers. Such an approach creates an environment of resiliency and competitiveness for Alberta businesses and communities.

The Alberta Chambers of Commerce Recommends that the Government of Alberta:

- Implement an industrial, commercial and residential regulatory framework that allows customers to install district energy systems for the sharing of electricity and heat between tenants and neighboring buildings. Such a framework would include checks and balances to ensure cost controls are in place to protect end use customers.

- Include, support and promote district energy systems in programs and policies aimed at helping drive Alberta and Canada’s climate change aspirations, more resilient communities and a more competitive economy.

148 https://www.districtenergy.org/topics/district-energy-cities

149 http://www.auc.ab.ca/regulatory_documents/Consultations/DistributionGenerationReport.pdf

150 https://www.bing.com/videos/search?q=youtube+atco+microgen- renewables&view=detail&mid=8200969BCACD8C2BCEE18200969BCACD8C2BCEE1&FORM=VIRE

151 https://questcanada.org/

152 http://www.auc.ab.ca/regulatory_documents/Consultations/DistributionGenerationReport.pdf

Efficiencies at the Alberta Land Titles Office

Issue

The Alberta Land Titles Office is currently delayed four months in processing documents submitted for registration. The delay affects individuals buying and selling properties; lenders registering a mortgage; creditors enforcing civil claims judgments; individuals applying for building and development permits; municipal tax departments issuing tax notices; and industries involved in finalizing real estate transactions. This is an urgent issue, and it must be resolved as soon as possible.

Background

As of January 21, 2023, the current delay at the Alberta Land Titles Office for processing registrations is over 4 months.396 The delay in processing documents has been an issue for stakeholders since 2021.

The processing delay has had a negative impact for all home buyers. The current delay in processing registrations means that buyers of recently purchased properties do not receive a certificate of title confirming ownership for over 4 months after closing of the transaction. In addition, new homeowners are experiencing delays in applying for building and development permits as a direct result of the processing delay at the Alberta Land Titles Office.

The delay has had negative effects on both municipalities as well as homeowners. Property Tax Assessments are not being sent out in a timely manner and are often sent to the previous owner of a property which was recently sold.

The delay has also had a negative impact on business. Law firms must wait until registration has been completed prior to finalizing their report and account. This has caused cash flow issues for some as a result. In addition, certain lenders have pulled out of real estate transactions because of the long delay.

Other jurisdictions in Canada have a streamlined process which enables registration to occur in a timely manner. Saskatchewan and British Columbia currently register documents submitted in less than two weeks.

Whilst we applaud Service Alberta for its attempts to rectify this issue over the past 18 months, more needs to be done, as the unacceptable delays in processing registrations still exist.

We recommend the Alberta Government commit to rectifying the current delays at the Alberta Land Titles Office. Efficiency is particularly important to business and individuals, and it is imperative that the Alberta Land Titles Office return to timely processing speeds.

The Alberta Chambers of Commerce recommends that the Government of Alberta work with industry and stakeholders to address the lengthy processing delays by:

1. Increasing staffing to adequately deal with current processing volumes;

2. Develop an action plan to quickly and effectively remove current system delays and modernize the Alberta land titles system, creating a reliable, responsive, timely, secure and sustainable system able to meet market demands into the future, including:

- Legislation and investment that supports modern technology and best practices;

- An innovative and digitized platform that facilitates online business transactions, potentially applying solutions which have been successfully implemented in other Provinces;

- Streamlined operations and overall business practices to ensure documents submitted to the Alberta Land Titles Office are processed efficiently and effectively, with a goal that documents will be processed no later than 30 days after submission.

396 SpinIIHost (gov.ab.ca)

Dec 04, 2023

Land Titles backlog eliminated

Alberta’s government has eliminated the backlog in the Land Titles office, and for the first time in more than two years, processing times are back to normal.

Between April 2021 and December 2022, requests at Alberta’s Land Titles office increased by 86 per cent. This increase was a response to Alberta’s growing population and economy, and wait times were exacerbated through the COVID-19 pandemic.

To tackle the delays, the government increased funding and staffing to the office, and kept counter service closed past the pandemic to address the backlog. Now that processing times have been reduced, Albertans doing real estate transactions, and the professionals supporting them, can focus on investment and economic growth.

“The successful elimination of a two-year backlog in land titles brings renewed economic growth and prosperity to the province. Land titles are vital for sectors like real estate, agriculture and resource development, as they ensure legal ownership and facilitate transactions. Through collaboration with employees and industry stakeholders, the land title registration process has been streamlined, resulting in a significant boost to the Alberta economy.”

- Dale Nally, Minister of Service Alberta and Red Tape Reduction

Every day, more than $340 million in economic activity is processed through Alberta’s Land Titles office, so addressing this backlog was crucial. Processing times peaked in December 2022, when Albertans were experiencing 84 days to process a transfer and register a title and 55 business days for surveys. Now, those processing times are down to 10 to 12 days, the lowest in more than two years. With processing times back to normal, full front counter service has reopened to the public.

“We want to commend Minister Nally and staff at the Land Titles office for the incredible progress made on addressing delays in land titles. By eliminating the backlog in the short term while committing to a modernized system in the long term, the Government of Alberta is supporting a reduction in red tape, costs and the unnecessary delays that have prevented Albertans from getting into homes.”

- Scott Fash, chief executive officer, Building Industry and Land Development Association Alberta

“This announcement will help to vastly improve wait times for all and ultimately allow legal professionals to ensure their clients are being serviced in a timely and professional manner. This is a huge step forward and the AAPP is looking forward to working with government on continued process improvements in other areas that impact Albertans.”

- Heidi Semkowich, president, Alberta Association of Professional Paralegals

Alberta’s government is investing nearly $60 million over three years to replace Land Titles’ outdated systems and improve service delivery. Currently, many of these systems are paper-based and ill-equipped to respond to changing market conditions. When this work is complete, it is expected documents will be processed within five business days.

Quick facts

- More than $50 billion in real estate transactions are conducted in Alberta every year.

- More than $500 billion in private property is managed through the Land Titles registry.

- The Land Titles office has two locations: one in Edmonton and one in Calgary.

- To ensure statutory compliance and property rights of owners, the Land Titles office conducts careful and thorough reviews of all documents and plans that are submitted.

- All changes to title (i.e., who owns the land) must be registered with the Land Titles office.

Related information

Land titles

Modernization of Alberta Registry Agents

Issue

The Government of Alberta regulates the Alberta Registry Agents’ (ARAs) Regulation by capping the fee amounts for most of the services they provide. In addition, Registry Agents are eager to develop a modernization plan to enhance services, including online registry services to Albertans in conjunction with Service Alberta and other stakeholders. The Government of Alberta should support these modernization efforts and review regulations to ensure Alberta Registry Agents can continue their vital work effectively.

Background

Alberta’s Authorized Registry Agents form a network that collectively employs over 1,500 Albertans. There are 217 Agents located in 150 Alberta communities (58 or 27% are in Calgary and Edmonton, 48 or 22% are in small municipalities, and 111 or 51% are in rural municipalities). Registries are a vital part of Albertan communities in providing economic growth, stable jobs, important community links, and essential services.

Albertans value registry services and continue to take advantage of the ease of access offered by local registry agents. In survey findings, 74% of respondents have visited a registry agent in the last year. Furthermore, over 90% of respondents expressed the importance of having access to registry services located in their communities and felt that it would have a negative impact on their communities if their local Registry Agent were to close.397

As registry services modernize to meet the needs of our society, Albertans must continue to have equal access to quality in-person registry services, regardless of where they live in the province. A healthy industry ensures ongoing service to Albertans throughout the province at an affordable price. Eight registry offices have closed in the last two and a half years and many more communities are at risk of losing their local registry. An independent third-party audit found that registry agents who have an annual volume of 10,000 transactions or less are operating at a loss, which represents sixty- four registries.

Unlike other similar provincially regulated industries, there is no regular mechanism to review government capped registry service fees. In order for the registry agent network to position itself to serve the diverse needs of all Albertans, it is essential for a fee review model be put in place that includes regular and predictable reviews of capped service charges that provides financial stability and long-term assurance of sustainability. Between 2005 and 2020, registry agents received no increases to capped service fees despite increased cost pressures. A static capped fee restricts registry agents from keeping pace with natural operational increases and limits the amount of capital that can be reinvested into businesses in order to expand and modernize their delivery models in a variety of settings.

A combination of rural, urban, online, and in-person delivery models offered by Registry Agents are needed to provide Albertans services for over 200 products on behalf of five government departments. In order to ensure that registry agents are equipped and can work effectively and efficiently, having the support of the government is crucial. A modern and viable business model needs to be developed to guarantee the levels of service and access is not only maintained but also expanded to reflect the dynamic nature of the industry. Additionally, the Government of Alberta is still in direct competition with Registry Agents for some online services, like traffic fines.

Other organizations also see the value in a new fee review model and the modernization of the industry to ensure the continuance of the high level of service which Albertans have come to expect from their Registry Agents. In 2016, the Alberta Urban Municipalities Association (AUMA) passed a resolution recognizing the “vital role and positive impact that ARAs have in Alberta communities” and recommended the Government of Alberta negotiate a new fee structure and protect ARAs revenue streams.398

The Government of Alberta responded on January 1, 2020399 by increasing capped fees only on certain services for the first time in 14 years. However, these changes alone without a long-term sustainability plan do not ensure both a sustainable business model and expansion of services for Registry agents, nor do they provide the support necessary to aid in the modernization of the Registry Agent Industry. The Government of Alberta should recognize the vital role of Registry Agents in the delivery of essential government services to all Albertans, particularly their positive impact in rural Alberta communities, and work to strengthen their partnership with the Association of Alberta Registry Agents and local municipalities.

The Alberta Chambers of Commerce recommends the Government of Alberta:

- Support further modernization of the Registry Agent Industry and red tape reduction.

- Continue to partner with Registry Agents to provide online services and allow registry services to expand online offering; and

- Ensure the long-term sustainability of Registry Agents, including those serving rural communities, with a fair and equitable service charge model.

397 Couillard, C. (2019, April 16). Opinion: Registry-agent services under threat by rising costs. Edmonton Journal. https://edmontonjournal.com/opinion/columnists/opinion-registry-agent-services-under-threat-by-rising-costs

398 Alberta Municipalities (2016). Sustainable Support for Local Registry Agents. https://www.abmunis.ca/resolution/sustainable-support-local-registry-agents

399 Government of Alberta. (2019). Fiscal Plan: A plan for jobs and the economy 2019-23. https://open.alberta.ca/dataset/3d732c88-68b0-4328-9e52-5d3273527204/resource/2b82a075-f8c2-4586- a2d83ce8528a24e1/download/budget-2019-fiscal-plan-2019-23.pdf

Streamline Size of Government

Issue

While government spending is needed to ensure the health and safety of its constituents, there are studies that have shown that when government grows beyond a certain size it can hinder economic growth and lead to an overall lowering of living standards.

Background

There are a variety of methods by which the size of a government can be measured. One method is based on per capita spending, and another is to consider government spending as a percentage of GDP. Both methods can also factor in measures for tax expenditures and regulation1. Following the inevitable major increase in fiscal year 2020 as a result of the COVID- 19 pandemic, there has not been a decrease in the size of our federal or provincial governments back to pre-pandemic levels234.

The spending as a percentage of GDP of our federal government is among the highest it’s ever been5. A study released by the Fraser Institute in 2013 found that the optimal level for government spending as a percentage of GDP is 26%, after which the economic and societal benefits decline for each additional dollar spent6. Since 1870, the Canadian government has had expenditures as a percentage of GDP over 26% for 65 years. During World War II for the years of 1942-1945 government spending averaged 44.62% which is typical for wartime expenditures. This was followed by a 15-year period during which expenditures ranged from 14.03% to 22.16% with an average of 15.77%. Since 1961, the government has not had a single year with expenditures below 29% (lowest was 29.66% in 1964) and has even spent as much as 53.34% in 1992. This has resulted in an average yearly expenditure of 41.31% for the years between 1961 and 2021. Furthermore, the percentage spent has been trending upward for this same period.

On a provincial level, the data demonstrates a similar trend. There have been consistent increases in spending per capita since 2007, with increases ranging from just 0.65% in 2013 to 9.76% in 200778 with an average increase of 2.76% between 2007 and 2021. A report released by the Financial Accountability Office of Ontario in April of 2022 shows that, comparatively, Alberta has the lowest per capita revenue in 2020, yet was consistently above the average in regard to program spending9.

The consistent growth in government expenditures per capita and relative to GDP, if left unchecked, can result in deficit budgets, and increases in debt and associated debt repayment costs. The Parliamentary Budget Officer released its Economic and Fiscal Outlook in October of 2022 projecting a year-over-year decrease in budget deficit, but a significant increase in debt servicing charges. In fact, there is an anticipated doubling of public debt charges from their 2020-2021 levels to $47.6 billion in 2027-202810. Despite being debt free in the early 2000’s, the Alberta government has run deficits since 2008-2009 which has resulted in steadily increasing debt11. Furthermore, the associated debt servicing costs are expected to continue increasing beyond $2.7 billion in fiscal year 2022-202312.

While the growth of the size of government and associated debt can at times seem inevitable, there is a solution in Canada’s not-so-recent past. Canada has successfully navigated out of a position where the growth of the economy was seriously impeded and Canadian’s prosperity was at risk as a result of the size of government and its related spending. Steps to put Canada back on a road of fiscal sovereignty were taken by successive governments starting in the mid 80’s and culminating in the Government of Canada initiating a Program Review in 1994. This program review, implemented over five years, rejected the concept of across-the-board cuts and the idea that a sizable deficit could be eliminated through increased productivity. Instead, it focused on the roles and importance of government programs and services within the overall fiscal framework. The program review was not about “what to cut” but instead used methods of fiscal constraint while considering “what to preserve” to put the country on a footing that would allow it to prosper in the future.

The foundation for this review used a series of six questions when looking at the services and programs administered by the government.

1. Does the program or activity continue to serve the public interest?

2. Is there a legitimate and necessary role for government in this program area or activity?

3. Is the current role of the government appropriate or is the program a candidate for realignment with the provinces?

4. What activities or programs should, or could, be transferred in whole or in part to the private or voluntary sector?

5. If the program or activity continues, how could its efficiency be improved?

6. Is the resultant package of programs and activities affordable within the fiscal restraint? If not, what programs or activities should be abandoned?

The result of this ongoing process looped back on itself if the overall proposal did not generate significant savings13. In addition, this process ensured that the federal government used only the resources it needed to deliver services strictly within the government's purview. As a result of this program review, Canada's total government spending as a share of GDP fell from a peak of 53 percent in 1992 to 39 percent in 2007, and despite this more than one-quarter decline in the size of government, the economy grew, the job market expanded, and poverty rates fell dramatically14.

The rationale behind having a government that is scaled properly to deliver essential services is not just one borne from a budgetary standpoint. When a government functions efficiently and uses its resources to their maximum potential it could be argued that it is on a much better footing when the economy or market forces pose challenges. Ensuring that government has the ability to adapt, maneuver, and respond to weather economic headwinds is dependent on how its resources are allocated.

This is not to be confused with across-the-board cuts and freezes that affect programs and services or by strictly asking departments and agencies to do more with less. What is needed is a repositioning of the role of government within the collective means of citizens using the criteria above. An essential component of this course of action would be a comprehensive review of the regulatory environment, using the recommendations set forth by the Canadian Chamber of Commerce in the Regulate Smarter report, Death by 130,000 Cuts: Improving Canada’s Regulatory Competitiveness15. The recommendations laid out in this report mirror the reasoning behind a comprehensive full program review. By modernizing Canada’s regulatory systems and reducing duplication and misalignment within regulations, competitiveness and a well-functioning regulatory regime will ensure a government ready and able to meet the challenges and respond to opportunities that present themselves in a more integrated global economy. This would ensure that protective measures would be balanced with a regime that is navigable and preserves economic growth and competitiveness.

However, the longer the process of streamlining government is delayed the harder it is to reset. External factors beyond the government’s control can take precedence and make needed changes that much more difficult. An immediate first step is to aim for government, both federal and provincial budgets that are balanced. This will then set a solid foundation allowing for a re-visioning of size of government. Canada and Alberta need to ensure we are set on a firm fiscal footing in order to allow for flexibility should market forces create downward economic pressure resulting in the continued need for stimulus spending. It is not only good fiscal policy but responsible governing to create a safe cushion for the province and country.

As in the past this exercise will be one that requires a long-term vision that spans government administrations and political parties. Good government is not a question of ideology, right or left, but rather a commitment to a government structure that is more accessible, navigable, competitive and streamlined so that all Canadians benefit and prosper.

The Alberta Chambers of Commerce recommends the Government of Alberta and Government of Canada

- Initiate a review of all ministries that evaluates the ministry focus and alignment, to be consistent with other provinces, territories and federal government ministries, as well as alignment with service delivery and focus areas based on private and voluntary sectors;

- Work towards consistency in government ministries to avoid regular changes to ministry titles, related costs to implement changes to ministry titles and unnecessary uncertainty associated with regular changes within the Ministry and department staffing requirements;

- Commit to comprehensive regulatory reform based on cost-benefit analysis and rooted in economic competitiveness and efficient service and program delivery.

1 Macdonald-Laurier Institute – Estimating the True Size of Government in Canada: https://www.macdonaldlaurier.ca/size-of-government-in-canada/

2 Statistics Canada. (2022). Canadian classification of functions of government, by general government component (x 1,000,000). https://doi.org/10.25318/1010002401-eng

3 World Bank. (n.d.). GDP (current US$) - Canada. https://data.worldbank.org/indicator/NY.GDP.MKTP.CD?end=2021&locations=CA&most_recent_year_ desc=true& start=1960&view=chart